-

UPP Salary Slip 2026: Download UP Police Pay Slip, Pay Scale, Allowances & Structure

UPP salary slip: The Uttar Pradesh Police Department provides an official monthly salary slip to all employees. It gives an item-wise breakup of earnings, allowances, and deductions credited to police personnel, including Constables, Sub-Inspectors (SI), Inspectors, and other ranks. Salary slip UP Police is also based on the Nominal Roll System, which means that whenever the salary is…

-

Why Dealerships Are Replacing Flyers with Digital Screens

If you’ve walked into a car dealership recently, you might have noticed something different. Instead of racks of printed flyers announcing promotions, new arrivals, or service specials, many dealerships are now showcasing sleek digital screens. The shift isn’t just about looking modern—it’s about making communication faster, more engaging, and far more effective. At VenueVision, we’ve…

-

Employee Salary Slip Explained: Easy Guide to Earnings, Deductions & Monthly Pay Structure 2026

The salary slip of an employee is one of the significant financial documents for a salaried individual in India. Checking employee monthly salary slip, downloading employee salary slip for India Post, accessing employee salary slip for UP Govt, knowledge about your earnings & deductions definitely makes it easier for you to manage your taxes, savings, and plan…

-

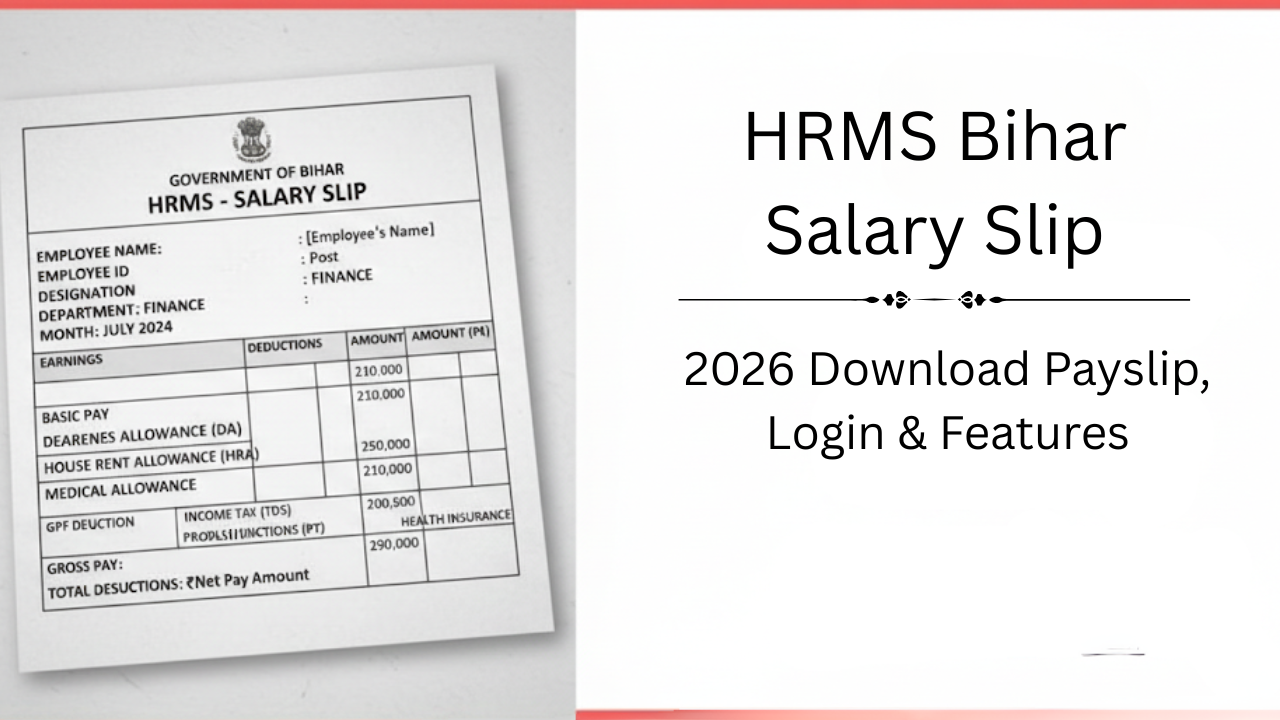

HRMS Bihar Salary Slip 2026: Download Payslip, Login & Features

HRMS Bihar Portal: A digital human resource management system for managing Employee Services launched by the Government of Bihar. It has completely redesigned government payroll, service records, and entitlements. HRMS Bihar Salary Slip 2023. One of the highly sought-after facilities of the portal is the HRMS Bihar Salary Slip, under which the employees can check their month…

-

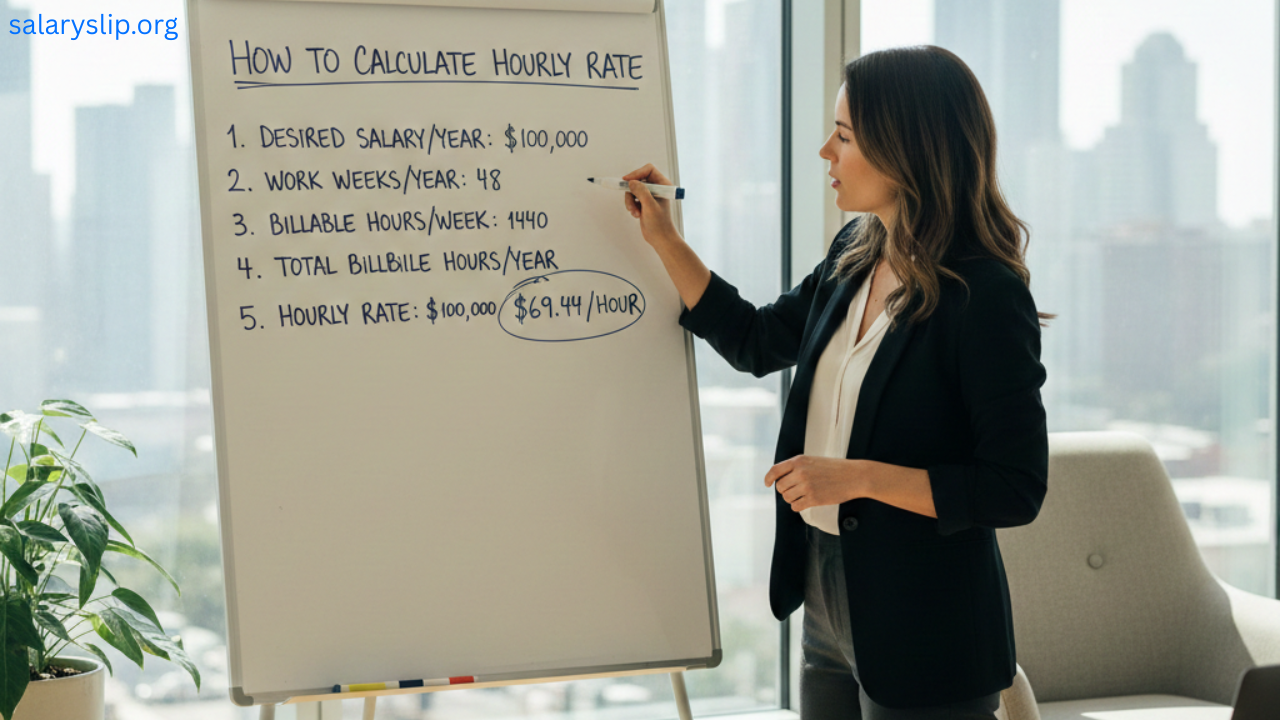

How to Calculate Hourly Rate: Easy Salary to Hourly Calculation Guide (2026)

Be it an employee, a freelancer, or an employer, understanding how to calculate hourly rate is crucial. Converting salary into an hourly rate provides clarity on actual earnings, whether comparing job offers, budgeting for payroll expenses, or negotiating pay. Introduction to calculate hourly rate from salary, monthly, weekly, bi-weekly, and daily wages with examples and formulas. What Is…

-

If You Work For Apple, Here’s How You Can Manage Your Finances

Working for Apple comes with incredible perks—competitive salaries, stock options, and comprehensive benefits. However, managing these financial opportunities wisely is essential to building long-term wealth and security. From understanding your compensation package to planning for retirement, here’s how Apple employees can take control of their financial future. Understand Your Compensation Package Apple offers a unique…

-

Gadgetfreeks.com Review 2026: Complete Analysis, Features, Safety & Content Quality

This has made the technology-related website harder and harder to believe in 2026. Published on hundreds of platforms every day, with all sorts of interests streamlining gadget reviews, updates, and journals related to the dimensions of this vast universe, users often have a very hard time figuring out which of these sources to bank on. Gadgetfreeks.com One…

-

Level Up Your Career: The Best Online Tools for Professional Development

In today’s fast-changing job market, staying relevant isn’t optional — it’s essential. Professionals across industries are turning to online tools to sharpen their skills, grow their networks, and build personal brands that stand out. Whether you’re looking to master new software, develop leadership skills, or create a professional portfolio, the right online tools make all…

-

How to Negotiate Salary in 2026: Complete Guide

Pay negotiations are a vital but uncomfortable part of growing up in a career path. For many professionals, saying something feels risky – like they will be seen as demanding, rude, or ungrateful. Know that salary negotiations are a natural part of being employed, whether you are starting at a new company or simply going after a…

-

Essential Guide to Nurse Salary in India 2026: Monthly Pay & Government Jobs

Among all healthcare professions, nursing is one of the most revered and robust professions. The nursing profession is highly recognized for career growth, job security, and lucrative income opportunities, not just in India, but abroad as well, due to the increasing need for skilled medical professionals right now. If you are taking the guidelines for preparing a…