The salary slip, also called a payslip, serves as an official document outlining a worker’s salary and deductions. Salary Slip Format can be provided as an official payslip. Each month, employees get hold of pay slips from their employers detailing critical data, which include the company’s name, the employee’s designation, area, and bank info.

Within the salary slip, there are key components. Salary, together with basic pay, dearness allowance, rent allowance, medical allowance, and unique allowance, are mentioned. Additionally, deductions such as expert tax, tax deduction at source, and worker provident fund are also particular. It’s important to mention that this information can vary from one company to another.

In this article, we’ll delve into the importance of the salary slip format or pay slip, explaining its importance in a financial context. Here, we also tell you about the format of salary slips in Excel, word, and PDF.

What is the Original Salary Slip Format Or Pay Slip Template?

A salary slip can be defined as a file that contains the details of a worker’s salary. These details consist of the basic pay, bonuses, deductions, etc, which are given to the employee every month by the agency. The employees frequently get copies of the same and, at events, are given different copies as well. Read More About What is Salary Slip.

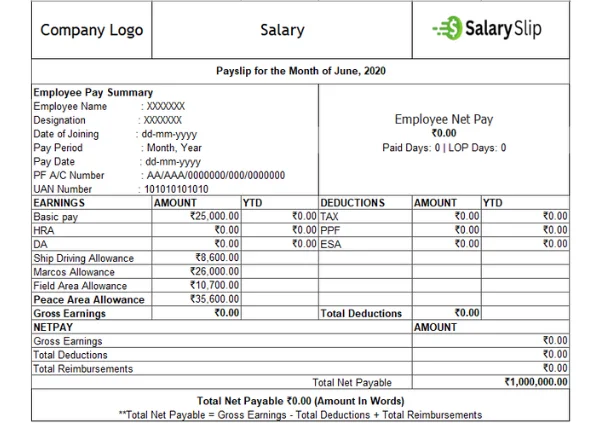

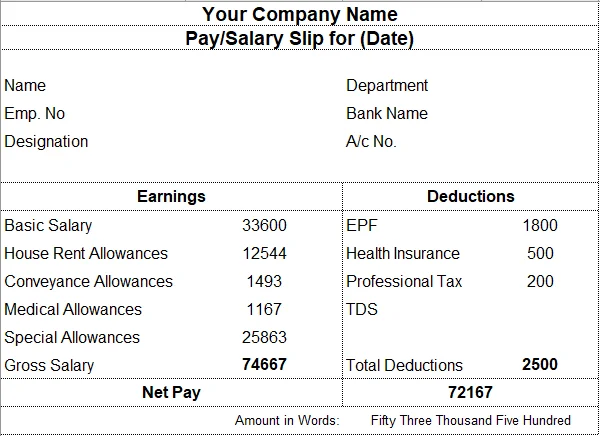

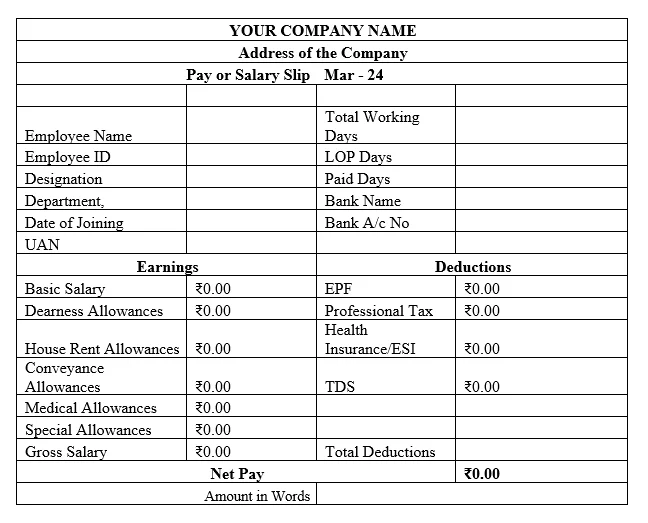

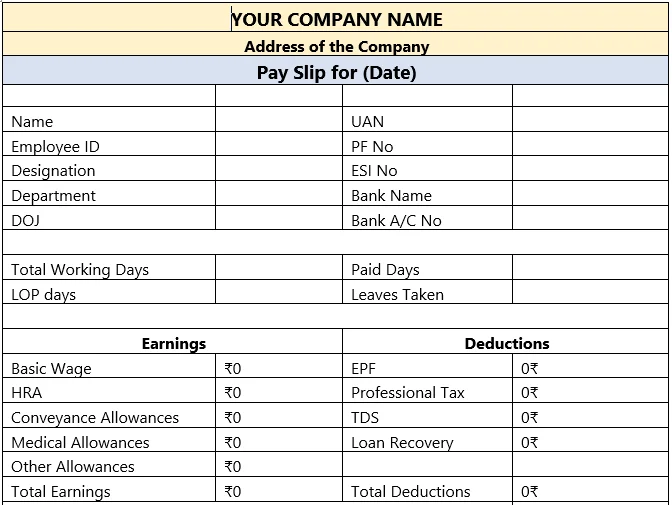

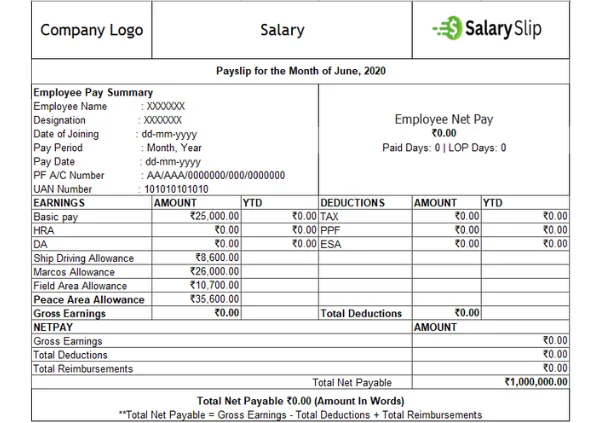

General Salary Slip Format or Payslip Format of Any Organization

How to Online Downlaod Employee Salary Slip Format in Excel, Word and PDF?

All formats are available here, so you can easily proceed with Salary Slip Download.”

What are Important Components of Salary Slip/Pay Slip?

Grasping the deductions on your salary slip, consisting of Provident Fund, expert tax, tax deductible at source, and Employee State Insurance, assists you in knowing your universal financial commitments and financial savings. These deductions create financial safety, ensuring access to other benefits.

Your salary slip in PDF form, which you get hold of each month, isn’t just a piece of paper to be used for loan applications. It holds the utmost significance in diverse aspects of economic management. It’s crucial to know the economic intricacies inside your salary slip so that you can manipulate your economic future. By learning the components of a salary slip, you may make knowledgeable choices on finance and make sure that you are in charge of your salary and investments.

The components of the salary slip can be divided into elements: Employee Salary and Allowances and Deductions.

Employee Salary and Allowances Provided by Company

The components in employee salary and allowances given by the company are mentioned below

1. Basic Salary

This is the number one component of a worker’s salary structure. It constitutes a vast portion of the salary; however, it is taxable. Basic pay is generally higher at the entry level and progressively gives way to other allowances as employees climb to higher positions.

2. Dearness Allowance (DA)

DA is a dynamic aspect, and this is immediately encouraged with the aid of the value of living modifications due to inflation. It caters to diverse locations and guarantees truthful repayment relative to the nearby economic situations. Although taxable, DA attempts to stabilize the workers’ buying power towards the rising rate.

3. House Rent Allowance (HRA)

HRA is designed for employees living in rented motels. It presents tax exemptions primarily based on the hire paid, which can be a massive financial comfort. The exemptions are governed by specific percentages and rent-charge criteria, permitting employees to optimize tax savings based on dwelling preparations.

For rented houses, the exemption is 50% (metros) or 40% (others) of Basic. Tax exemption standards encompass actual rent paid minus 10% of pay (Basic + DA), actual HRA acquired, and 50%/40% of (Basic + DA) based on city. Read In Detail About HRA or Housing Rent Allowance

4. Conveyance Allowance

Commuting is a day-by-day fact for most employees. Conveyance allowance knows these expenses by providing tax exemptions up to a particular limit. It represents a crucial financial relief for plenty, making their everyday experience of work more financially attainable. The exemption restriction is up to ₹ 1600/month or the Amount acquired as salary. Read in Detail About Conveyance Allowance.

5. Medical Allowance

Medical allowance assists the employee in protecting scientific fees and catering to their healthcare wishes. Tax exemptions are contingent on submitting medical bills, encouraging employees to maintain their general health and well-being. The allowance underscores the company’s dedication to worker welfare. The exemption restriction is as much as ₹ 15,000/year if proof is submitted. Read in Detail About Medical Allowance.

6. Leave Travel Allowance (LTA)

LTA is meant to offer tax benefits for employee tours, acknowledging their want for leisure and their own family time. It fosters healthy work-life stability and aligns with employees’ tour aspirations, ensuring periodic possibilities for rejuvenation. Its calculation is block-based. Read In Detail About Travel Allowance.

7. Special Allowance

Special allowances are designed to behave as effective motivators, encouraging the employee to perform well in their roles. Although fully taxable, they represent the business company’s recognition of fantastic performance. These allowances are frequently tailor-made to individual job roles, acknowledging and profitable specific skills and achievements.

8. CTC or Cost To Company

You don’t want to forget numerous components to calculate an employee’s rate to the employer (CTC). The fundamental salary is a percentage of the CTC, whilst the house rent allowance (HRA) is a percentage of the basic salary. The special allowance (SA) is the difference between the CTC and all other allowances. The provident fund (PF) is a percent of the basic salary, and the gratuity is based on years of provider and basic salary. Medical allowances and bonuses might be constant amounts or percentages of the CTC.

Lastly, there will be different allowances as well. Understanding these components leads to a more productive and hit business. Read in Detail About CTC

Also Read:- How To Calculate HRA in Salary | Salary Certificate Format | Salary Slip Definition

Deductions in Salary Slip Format by Employers

Various deductions are made from employees’ salaries:

1. Provident Fund (PF)

The Provident Fund (PF) is a worker financial savings device controlled under the Employees’ Provident Funds and Miscellaneous Provisions Act of 1952. This scheme calls for the employee to contribute a fixed percentage of their salary, which their organization matches. The contributions form a secure fund that the Employees Provident Fund Organization manages.

2. Professional Tax

This is a nation-imposed tax levied on all citizens earning a salary, varying in Amount across states. Individuals make an obligatory contribution from their salary, ensuring financial guidance for country initiatives.

3. Tax Deductible at Source (TDS)

TDS represents the Amount deducted from a salary at the supply of income. The entity making the fee removes this tax, ensuring compliance with tax policies. The salary recipient is answerable for this tax, streamlining the taxation system.

4. ESI

Employee State Insurance (ESI) is a social security scheme that safeguards employees all through challenging instances. ESI deductions are calculated based on the gross salary paid to employees. According to the ESI Act, the employer contributes 3.25% of the wages, while the worker contributes 0.75% to the contributory fund. This joint contribution creates an economic protection net, making sure employees have access to vital benefits and hospital treatment after they need it the most.

5. Gratuity

It is a financial advantage provided to the employee at the time of retirement. Companies commonly deduct a percent (4.81%) of an employee’s basic pay.

Importance of Salary Slip for Employees

Salary slips may be very vital in the professional world. They function as the legal proof of you being a salaried employee. It could be of incredible help to constantly hold them safe, as you’ll do with different significant documents.

- Proof of Employment: Pay slips endure a load of credibility in numerous respectable contexts. Whether applying for tour visas, university access, or undergoing heritage checks, a salary slip validates a person’s expert status. It no longer only affirms modern employment; it additionally delineates the career trajectory, imparting a comprehensive image of an individual’s designation within the organization and their usual employment history.

- Strategic Salary Tax Planning: Beyond their role in employment validation, salary slips serve a crucial reason in salary tax planning. The provision of an in-depth breakdown of salary and deductions in those files empowers employees to strategize their tax liabilities effectively. From basic salary to allowances and deductions together with Professional Tax, EPF, and TDS, salary slips provide insights that permit individuals to calculate TDS returns correctly. Furthermore, the resource in maximizing advantages from tax deductions, rebates, and allowances within the prison limitations stipulated by way of the Salary Tax Act of 1961. Effectively managed tax planning ensures economic prudence and permits individuals to navigate the complexities of the taxation system with self-belief.

- New Employment Opportunities: Salary slips become priceless property during salary negotiations and whilst exploring new employment possibilities. When accomplishing negotiations with potential employers, beyond salary slips, offer a tangible basis for discussions. They provide a clear historical perspective, enabling employees to advise for equitable reimbursement based on their preceding salary. In the realm of new employment, HR employees frequently request those documents for verification purposes, ensuring transparency and credibility within the negotiation manner.

- Facilitating Financial Transactions: Beyond their position in employment and taxation, salary slips are pivotal in facilitating economic transactions and credit management. When people practice for loans, credit cards, loans, or different styles of borrowing, financial institutions demand concrete evidence of a stable salary. Salary slips provide this guarantee, showcasing a person’s capacity to meet monthly charge duties. They not only set credit limits but additionally serve as a crucial eligibility criterion for numerous financial products. In essence, salary slips simplify personal finance management, enabling seamless financial transactions and fostering responsible credit practices.

The last three Months’ Salary Slip Format

When a maximum of you try to switch jobs, HR will request previous pay slips. Most importantly, HR requests the last three months’ pay slips.

- To check if you are within the salary variety for the placement. If your current salary is more than the offered salary, then HR will reject you. If your cutting-edge salary is much less than the offered salary, then the HR department will check on your designation and offer a designation that includes senior supervisor, VP, etc.

- HR released a request for a salary slip to check when you have been hired for the closing 3 months. There are probably some candidates who could have switched organizations in 2 months or 1 month. To check the previous heritage of an organization, ask for a payslip.

- Additionally, HR will try to make suggestions for different compensations aside from the take-home salary. Further, HR will check when you have any other benefits and attempt to provide a few extra benefits.

- To carefully examine your pay slips, HR requests most of the last 3 months’ salary slips. Here is a sample closing 3 months’ salary slip format that you could use to prepare the salary slip.

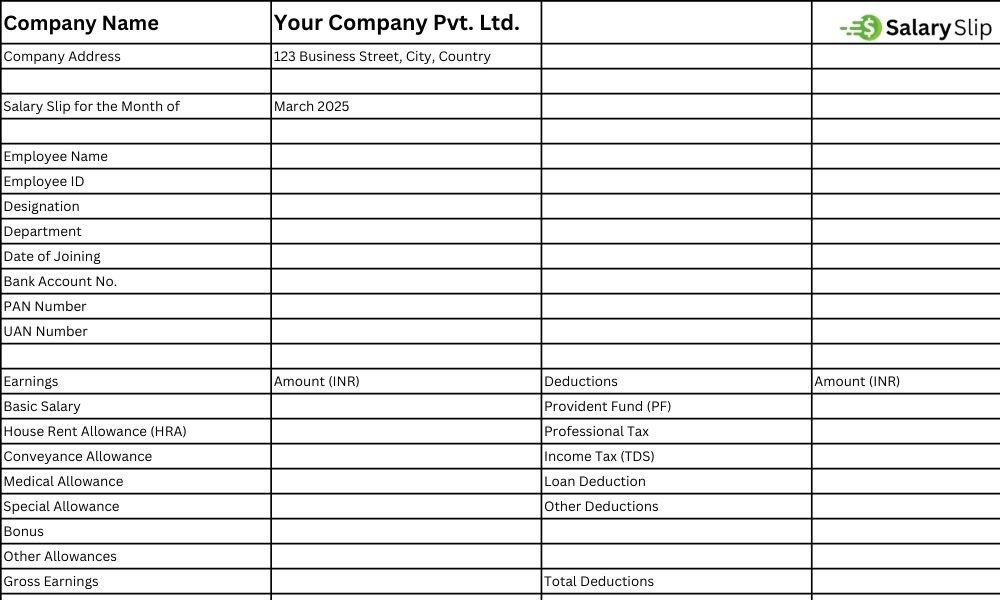

How To Download Sample Salary Slips from Google Sheets?

If you’re seeking out a brief and efficient way to control tasks like price range tracking or simple undertaking planning, pre-designed sheets that require minimal alteration may be very beneficial. In this sort of case, Google Sheets is a brilliant device for collaborative tasks, permitting you to work together seamlessly with no complications. It’s also cost-effective and integrates properly with different Google apps, making it the best choice for an all-in-one solution. The following steps will guide you on how to download salary slips on Google Sheets. Here are free payroll templates for Google Sheets; simply click on them right away!

- Monthly Payroll Template: Tracks monthly payroll, such as hours worked and taxes deducted.

- Annual Payroll Register: Monitors annual compensation and taxes. Both templates are easy to apply and may save you time. Download them now!

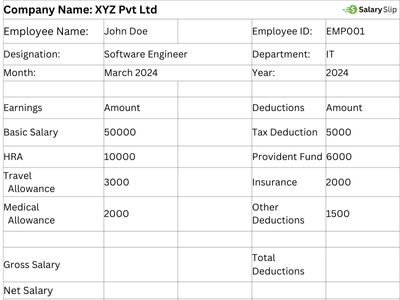

How to Create a Salary Slip for Employees?

To create an employee salary slip, these components and steps are necessary:

- Open a new spreadsheet.

- Add the organization name at the top of the sheet.

- In the best fields, input the employee’s name, ID, branch, and job title.

- Create three columns for salary, deductions, and net pay.

- Under the salary column, list all the allowances, extra time pay, health insurance, and other benefits the employee is entitled to.

- Under the deductions column, list all of the wages, house lease allowance (HRA), basic pay, and other deductions.

- Calculate the full salary and deductions and show them in separate boxes.

- Subtract the full deductions from the overall salary to get the total pay.

- Display the total pay in a separate box and make sure it’s far seen.

- Review the salary slip for accuracy and make necessary modifications before printing or distributing it to the employee.

Salary Slip Format for Contract Employees

Regarding salary slips for settlement employees, the salary slip format is crucial to include precise info to ensure accuracy and transparency. Contract employees must additionally acquire their salary slips as per Form XIX, which covers salary cycle, nature of work, wage fees, extra time info, gross salary, deductions, and actual salary paid. Here’s a basic format you could use

1) Employee Information

| Full name Address Social Security Number (SSN) Employee ID (if relevant) |

2) Payment Information

| Pay length dates Hourly fee or contract amount Total hours labored or assignment final touch percentage Gross pay Deductions (e.g., taxes, benefits) Net pay |

3) Employer Information

| Company name Address Employer Identification Number (EIN) |

Double-check all records before releasing charge slips to agreement employees to keep away from any discrepancies or errors.

Advantages of Creating Monthly Pay Slip in Excel

Creating monthly pay slips in Excel has numerous benefits, as mentioned below.

- Easy To Use: Excel allows easy customization of the pay slip to fulfill the company’s or employees’ specific needs.

- Automated Calculations: Excel provides numerous tools and formulations for calculating different deductions and taxes, which saves time and decreases errors.

- Electronic Storage: Pay slips may be without problems stored and accessed electronically, making monitoring and managing worker information more sincere.

- Cost-effectiveness: Creating payslips using Excel is more affordable than traditional payroll software programs, which may be high priced to buy and maintain.

- Professional Look: Excel’s formatting tools can make the pay slip appear, expert, organized, and easy to examine.

- Accuracy: Excel’s integrated functions can assist in ensuring the accuracy of calculations and reduce the risk of errors.

- Flexibility: Excel lets in smooth updates and changes to the pay slip template, making it extra flexible than traditional paper-primarily based systems.

Employee Salary Slip Format Without Deductions for Salaries under Rs. 3 Lakhs

If you are based totally in India and reach a salary under Rs 3 lakhs, no deductions might be made. Did you know that in advance?

| Salary Slip for [Employee Name] Salary: Basic Salary: Rs. [Amount] House Rent Allowance: Rs. [Amount] Conveyance Allowance: Rs. [Amount] Medical Allowance: Rs. [Amount] Special Allowance: Rs. [Amount] Gross Salary: Rs. [Amount] Deductions (No deductions for salaries beneath Rs. 3 Lakhs.) Net Salary: Rs. [Amount] [Company Name] Salary slip calculation formulation Here are the components to calculate salary slips in India, Net Salary = Gross Salary – Gross Deductions right here, Gross Salary = Basic Salary + HRA + All kinds of Allowances + Reimbursements + Arrears + Bonus Gross Deductions = Professional Tax + Public Provident Fund + Salary Tax + Insurance + Leave modifications + Loan repayments (if any) |

Conclusion

Salary slips are essential documents for all employees to have. But, 93% of Indian employees are unorganized and hence do not get salary slips. They, for that reason, can’t avail of loans as they need evidence of employment.

Q. What is the salary slip or pay slip?

The payslip also known as a salary slip. It is a legal financial record that serves as evidence of the money you receive from your employer. It shows every component of your pay, such as base pay, deducted expenses, tax paid, and both required and optional allowances.

Q. How do I get a Salary Certificate?

You must write a letter requesting a pay certificate from your current employer if you are an employee wanting one to submit as proof of income. Here are some pointers to remember, the letter should have a formal, courteous tone. Ensure that the format used for the wage certificate request is simple, clear, and brief.

Q. Are salary slips confidential?

Yes, a salary slip is a legal document of income and is confidential. You are free to decide who you want to know about it. The words “private and confidential” are usually found at the bottom of the company name on pay slips. A statement that only the employer and the employee have access to the wage slip document, which contains confidential information.

Q. What information should be included in the format of a salary slip for organizations?

In India, there is no standard format for salary slips used by employers. But certain information will be required to be included on every pay slip. The following information may be on the salary slip, depending on the type of firm and compliance with it.

1. The Salary Paid Month and Year

2. Name, address, UIN/CIN, TAN, and PAN of the employer

3. Name, Code, Designation, and Department of the Employee

4. PAN and bank account number of the employee

5. UAN (universal account number) and EPF account number

6. The Total Number of Work Days and Leave Days

7. Earnings (income) and Deductions Classification

8. Net Pay in Words and Numerics

9. Give it all to balance.

Q. How can I make a simple salary slip?

I can make a simple salary slip:

1. First, The Name of the company, address, logo, month, and year of the payment.

2. Particular employee’s name, employee code, job role, and department.

3. Personal information such as an Aadhar/PAN number and necessary bank details.

4. UAN (Universal Account Number) and EPF (Employees Provident Fund) account numbers.

Q. Where is a salary slip required?

The following are the reasons why you should keep your employee salary slips:

Employment Verification: Required for courses, visas, and job applications.

Tax Planning: Assists with ITR filing and tax bill calculation.

Loan applications: Find out a person’s trustworthiness for credit cards and loans.

Read More:- Veterinary Doctor Salary per Month || 8th pay commission salary calculator