Information About hourly to Salary form Salary slip, A salary certificate is a record that confirms a person’s salary and employment information. In this blog, we are able to discuss the salary certificate format, its significance, and the way to create one. There are many platforms that offer free salary certificates in Word format that you may download and use immediately. But first, permits cover the fundamentals.

What is a Salary Certificate?

A salary certificate is an important file that verifies a person’s salary and employment details. It serves as proof of salary and is required in several conditions, consisting of applying for loans, credit score cards, visas, and different documents. Additionally, employers may require a salary certificate whilst giving a worker a housing allowance or a vehicle loan.

As a company, you’ll need to provide salary certificates to your employees due to the fact your employees can be required to share their salary details with diverse entities inclusive of banks, authorities organizations, and different firms.

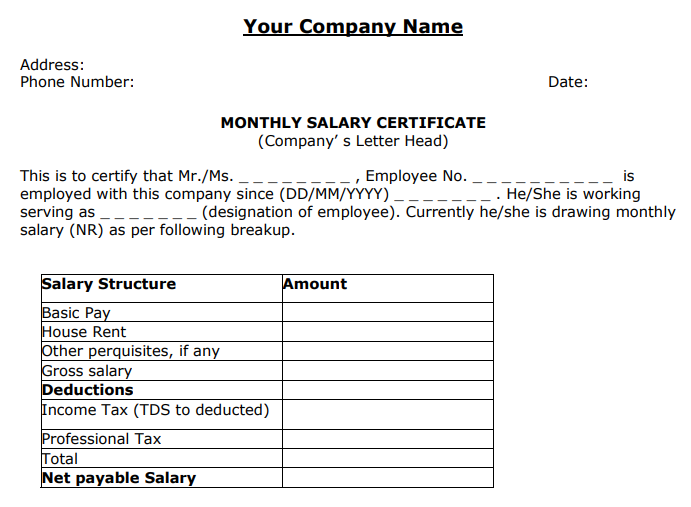

Format of salary certificates

The following information is mentioned in the salary certificate format

- Employee’s name and ID

- Name and deal of company

- Date of enrolment

- The date the certificate was issued

- The starting wage

- Allowances for things like house rent, transit, hospital costs, etc

- Salary general (base salary plus allowances)

- Deductions include taxes, provident finances, and so forth.

- Net salary (total salary less deductions)

The salary certificate format affords a salary summary, classification, and department for the employee. The particular format of a salary certificate is decided by current laws and regulations.

The salary certificate format is a preferred format that employers can use to speak information about their employee’s present-day or preceding wages. It frequently begins with an ID and then goes on to describe the requirements for the data to be mentioned in the salary report.

For all states, the critical structure of a pattern salary certificate is the same. The shape could be identical for all states. However, the format will fluctuate slightly depending on the necessities. Each person adheres to the laws and guidelines set up by the labor ministry.

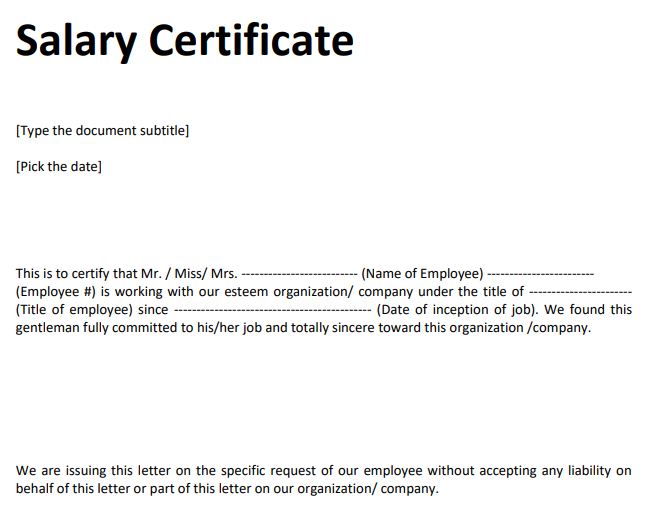

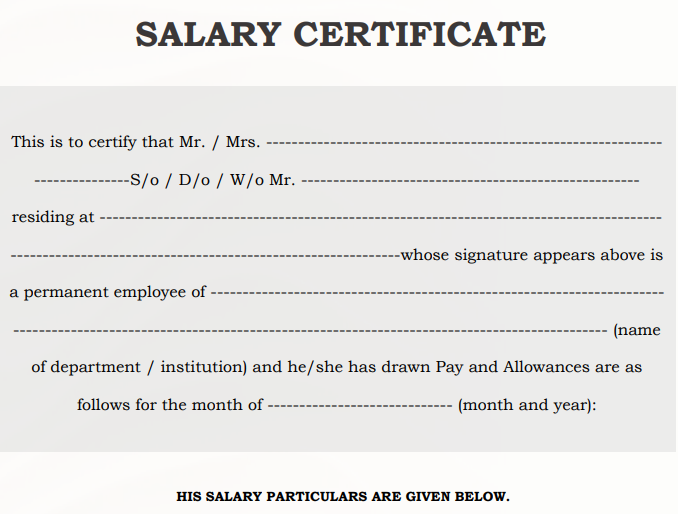

Salary Certificate Template For Download

The format of a salary certificate varies according to state, but below is an example of a salary certificate format.

Regulations installed by salary certificates are available in a number of formats, depending on employment settlement and duty. The salary certificate is typically given in format (letterhead, worker name, company seal, certifying date, and so on).

The salary certificate format is a report designed for your future promotion, as well as a letter of recommendation for any shop clerk. The salary certificate is utilized in almost all industries and sectors. The salary certificate format absolutely shows how much you received and your annual salary.

Format of an Employee Salary Certificate Employee Name

First Name:

First Initial:

Middle Initial:

Year of Birth:

Address:

(Home Telephone Number)

Fax No.:

Contact information via E- mail:

Designation:

Unless exempt from any Act/GSTR Act/TCS Law, offer the name and address of the agency.

If to be had, the name and address of the organization’s touch individual.

If a company calls for a copy of an ID card or a passport with a photo under any regulation, it’s far solely for verification purposes.

What Are the Different Parts of a Salary Slip?

The parts of a salary slip include all the heads affecting your gross salary. The heads are divided into Salary and Deductions. Let us recognize these two subcomponents in more elements.

1) Salary Components

The following parts normally form a part of your salary section in salary certificates.

- Basic Salary: The fundamental salary is the primary aspect of your salary. It is the basis of all other salary additives along with the deductions.

- Dearness Allowance: Dearness allowance is part of old corporate and government salary systems. It is supposed to be an allowance to compensate for inflation. Dearness allowance is predicted as a percent of primary salary. This allowance is completely taxable.

- House Rent Allowance: HRA, or house rent allowance, is to compensate you for the monthly charges for the house. This allowance is commonly up to 50% of your basic salary. HRA is partially taxable based on your town of house and rent paid.

- Conveyance Allowance: This is an allowance to compensate you for your everyday office commuting fees. This allowance is tax-free, as much as the restriction is defined in the annual Union Budget.

- Medical Allowance: A medical allowance is a totally taxable allowance as this comes under Section 80D, and the maximum restriction prescribed is Rs. 15,000 yearly.

- Leave Travel Allowance: Leave travel allowance is likewise a partially taxable allowance. This allowance is offered for an employee to journey to their native land twice in a block of 4 years.

- Special Allowance: Special allowance includes all of the ultimate part of your salary. This allowance is fully taxable. There are extraordinary categories of special allowance – non-public allowance and reliable allowance.

2) Tax breaks in Salary

The following components may show salary deduction amounts

- Provisional Funds: Your contribution, as well as your company’s contribution, to your provident price range, along with EPF or NPS, is indicated as a deduction on your salary slips.

- Taxation as a Profession: A professional tax is a country tax that applies to a unique career. If it applies to your activity, the deduction will show on your salary slips.

- Personal Salary Tax: Your monthly salary includes strengthened salary tax deductions. These deductions are calculated primarily based on anticipated salary for the economic year. You can reduce this deduction by informing your business enterprise about tax-saving investments.

- Paid and Unpaid Leaves: If you took any unpaid leaves all through the month, the withheld salary will be listed under this heading.

- Gratuities and Health Insurance Premiums: Although no longer part of your compensation, the company regularly consists of such worker perk contributions in CTC (price to the organization). If this is the case, the sums are deducted out of your salary.

The Importance of a Salary Slip

Salary slips are a critical part of your work documentation. Here are the following aspects that show the salary slip’s importance

- Functions as Proof of Employment: A wage slip is an easy document that proves your work.

- Becomes the idea for salary taxes: Different components of your salary may be taxed at distinctive costs. Your tax estimate for the financial year is based on the salary structure proven for your salary slips.

- Beneficial in Search for Future Employment: Your new agency’s wage is regularly primarily based on your previous compensation. Salary slips help you negotiate a higher wage for your future work.

- Assists in acquiring loans: Salary slips are an essential file to have handy whilst applying for a loan. Your loan eligibility can be determined via your wage shape and monthly salary.

- Proof of Salary for Insurance and Credit Cards: When acquiring lifestyle coverage, you need to provide proof of salary because your maximum existence coverage eligibility is decided with the aid of your salary. Similarly, your credit card restriction is determined with the aid of your salary. As a result, a salary slip serves as essential documentation of salary and employment for each party.

- Salary Certificate for Bank Loan in India: The maximum document that the bank or credit score card issuing organization will request from you when making use of a loan or acquiring a new credit card is your salary certificate. Your salary slips might be evaluated to determine if you will be capable of salary off your duties and interest on time.

How to Obtain an Employee Salary Certificate

A wage certificate is a vital file that a company affords to an employee after the employee is hired by a selected organization. The company is required to provide the employee with a Salary Certificate. Employees in government enterprises get hold of their salary certificates almost soon after being employed.

There isn’t potential for tiny and micro-companies or new startup organizations in India to provide a salary certificate to each of their employees. In any such circumstance, if the worker wants a salary certificate, he can ask his business enterprise to provide it by asking for the use of the Salary Certificate Request Letter. If an employee’s salary certificate is lost, he or she can request an option with the aid of writing a Salary certificate request letter to their company.

How Do I Create an Online Salary Certificate?

Here are the ways to create an online salary certificate. If you also want to create a salary certificate, then here are the steps you should follow

- Download the Salary certificates format in Word with the aid of clicking at the above link. Because the Word format is editable, the PDF model is not.

- Fill in the blanks along with your name, company’s name, position name, etc.

- Fill out all of the information about your salary and taxes.

- Verify all of the figures with documentation.

- After completion, go to your administrative center and reap your employer’s signature or the company’s.

Salary Certificate Application for an Employee

An employee salary certificate is each financial and the same tool. A salary certificate often confirms that a positive individual is or was a salaried worker of a selected organization. Salary certificates are used for the following functions apart from being an equal device:

- Salary verification for a bank loan: A bank regularly requests an individual’s salary certificate so as to determine and get access to a person’s trustworthiness or credit rating. It is used to decide whether or not a person will be capable of salary off his loan and interest on schedule.

- Tax act: Tax authorities use a salary certificate to evaluate whether or not or no longer a person is required to pay salary tax. It is likewise used to determine which tax bracket an individual will fall into under the Salary Tax Act of 1961.

- Loan/Credit Card Salary Certificate: The most giant report that the financial institution or credit card issuing agency will request from you when applying for a loan or obtaining a new credit score card is your salary certificate. Your salary slips may be evaluated to decide if you may be capable of salary off your responsibilities and interest on time.

Also Read:- Data Analyst Salary || Data Scientist Salary || Full Stack Developer Salary

What exactly is a salary certificate?

A salary letter is a letter that a worker sends to his or her organization inquiring for his or her salary to be released.

- Letter of Salary Certification:- A salary certificate letter is a letter released via an enterprise to an employee stating that the bearer occupies a role in a specific employer and has a decent, constant, and stable salary.

What’s the difference between a salary certificate and a salary certificate letter?

A salary certificate is a file presented via an organization to a worker through the recruitment technique that confirms the bearer is a salaried employee of a selected agency. It also specifies the numerous headings under which the worker’s wage could be determined.

Whereas

A salary certificate letter is a letter sent by a company to a worker stating that the bearer occupies a role in a specific organization and has a decent, constant, and stable salary.

What exactly is a salary slip/salary slip?

A salary slip is a document given to an employee via his or her enterprise as proof of employment. It describes how the salary is computed in spite of all allowances and deductions that are taken into consideration. The salary slip carries the real wage amounts and is added on every occasion the organization salary the worker.

Also Read:-BSc Nursing Salary || Air Hostess Salary || CRPF Salary || Cyber Security Salary

Difference between Salary Certificate and Salary Slip

A worker’s salary certificate consists of various salary-related info inclusive of salary and deductions. It also indicates the connection between the employee and the enterprise. Whereas the salary slips consist of monthly salary info and are issued monthly for an employee. At the same time, the salary certificate is based totally on a selected length, which can be a year or the entire agency’s tenure.

| Salary Certificate | Salary Slip |

| Issued by using the agency, it proves your employment status in the enterprise. | It presents distinct information on the salary of a worker |

| It does not include a detailed employee’s monthly salary structure | It carries facts on a worker’s month-to-month salary structure |

| It is proof of salary but doesn’t show the financial status of the employee | It is proof of employment in addition to showing the exact financial status of the worker |

Components that must be included in our salary certificates

The following are the essential components that we should include in the salary certificate

- Employee’s Name

- The name and address of the agency

- Employee ID (if to be had)

- Employee designation and branch (branch).

- Employee’s Beginning Date

- Employee Salary Breakdown

Conclusion

An employee salary certificate is a vital report for employees and employers alike. It serves as proof of salary and employment and is often required for numerous purposes, inclusive of loan applications or visa processing.

The format of a salary certificate may rely on the organization’s regulations and the record’s motive. However, it generally includes information consisting of the worker’s name, designation, salary form, deductions crafted from their salary, and net salary. Ensuring your salary certificate is updated and correct permits you to keep away from any delays or headaches in your financial dealings.

FAQs :

1) What is the Salary Certificate?

A Salary Certificate is a document provided by the company to an employee that confirms his/her association with a firm or company. It contains an employee’s important details, like tenure, designation, employee ID, and salary details in detail. Proof of Income is required on various occasions like when applying for loans, credit cards, visas, and so on.

2) What is the Salary Certificate format?

There is no predetermined structure for a salary certificate and changes from company to company. However, the salary certificates must include details like the employee’s name and ID, company name, date of enrolment, date of certificate issued, the starting wage, allowances given by the company, Salary general (base salary plus allowances), deductions including taxes, provident finances, net salary (total salary less deductions), and so on.

3) What details should be included in the salary certificate?

The salary certificate must include the name and employee ID of the employee, address, designation, work location, work tenure, and salary breakdown containing allowances, deductions, and more. Some salary certificates also have employee’s work ethics and behavior in the office.

4) What is the difference between a salary certificate and a salary slip?

Employees regularly get their payslips or paychecks each month, which include a breakdown of their salary along with information on taxes and deductions. On the other hand, the salary certificate serves as a summary of the employee’s earnings and financial information for a given time frame.

5) Why is a salary certificate important?

An employee receives a salary certificate on leaving the company and on joining another company, the new employer might ask them for a salary certificate. This salary certificate (Letter is Proof) of an employee’s association with the company contains important details like designation, date of joining, salary breakup, allowances, and more. Based on these given details, the candidate ask for an increment in the new company.

6) What is the salary certificate format for the bank loan?

Salary certificates format for bank loans are often provided without a set format. An employee’s tenure and other key information about their salary breakdown are included in the salary certificate format.

Recommended:- Hourly to Salary United States || Electrician Salary United States || Graphic Designer Salary