EPFO stands for the Employees Provident Fund Organization, a statutory body established by the Indian government. This organization’s primary work is managing EPF under the Employee’s Provident Fund Miscellaneous Provision Act 1952. Since then, it has been providing its services to its customers. The organization works under the Ministry of Labour and Employment and is known to be a famous organization. This article will discuss the EPFO portal, how to log into it, the registration process, etc.

Process of EPFO Member Login

You can follow the easy steps to register for the EPFO portal. However, here are the quick and easy steps for the registration.

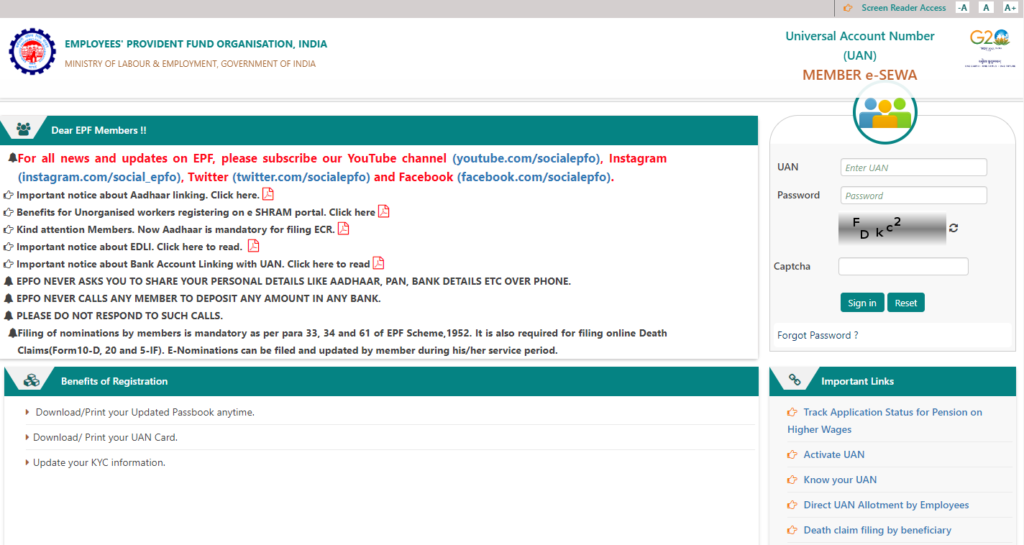

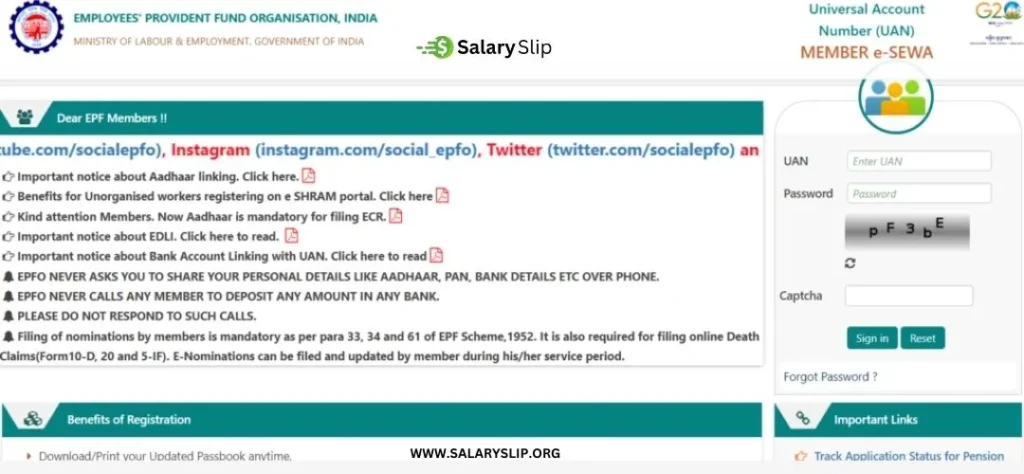

- First, you have to visit the official website of the EPFO Unified portal, which is given below:

https://unifedportal-mem.epfindia.gov.in/memberinterface

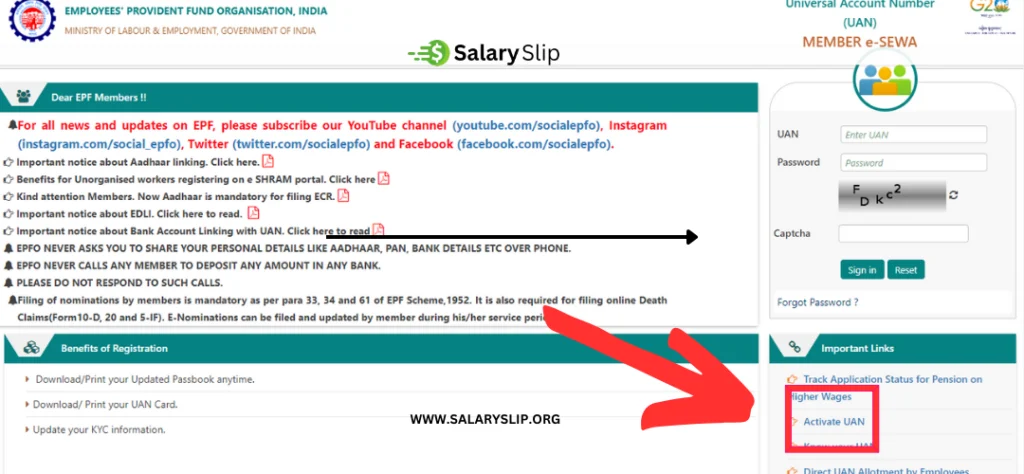

- Now go to the home page and click on the button to activate UAN,

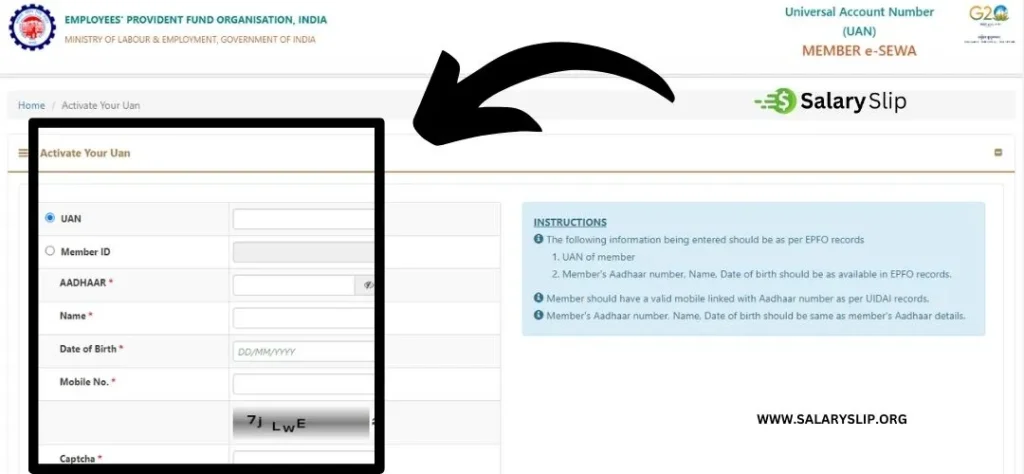

- Please enter all the necessary details, such as the UAN number, mobile number, and member ID, which our EmployeeEmployee provides. Apart from this, fill in more information like name, date of birth, email ID, etc.

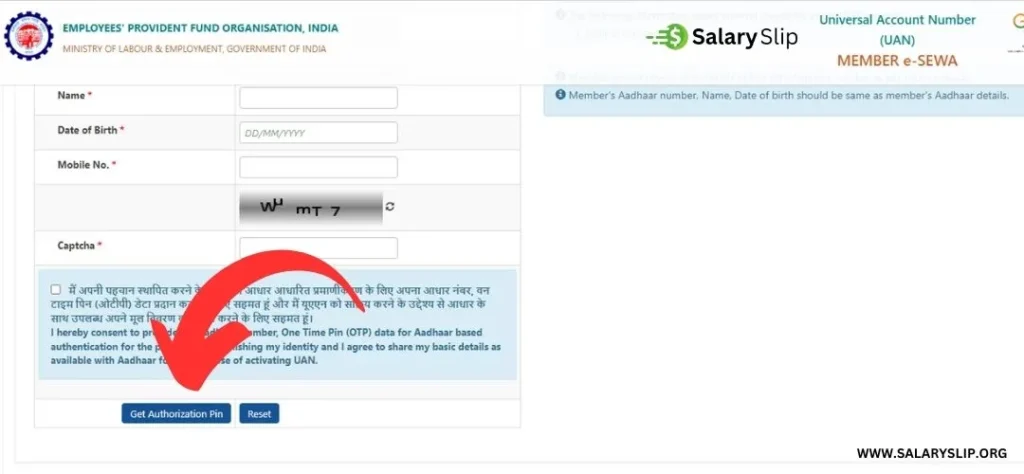

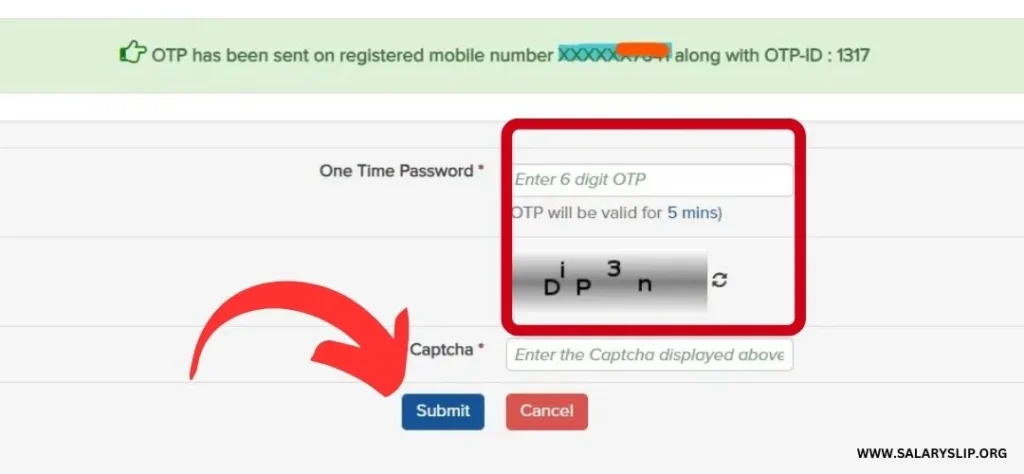

- After filling in all the necessary details, click on the button ‘GET AUTHORIZATION PIN ’ button, which is given below. After clicking this button, the OTP was sent to your registered mobile number.

- Enter the OTP carefully and click on the submit button.

- After verification, you need to set a password for your EPF account.

- After setting a strong password, your account will be activated and you can log in with the help of UAN or password for checking the details.

How to Change EPFO Password?

We often need help remembering our password, making it challenging to enter into the account. However, you can reset your password easily by following these steps.

- To reset your EPFO password, visit the EPFO/UAN member E-Sewa portal and click on forgetting password.

- Enter your UAN account and verify it by filling out the correct captcha.

- Now, fill in all the necessary details, such as name, date of birth, and gender, which you registered with your EPFO account. Click on “verify” to confirm identity.

- Enter your Aadhar card details and captcha carefully and click ‘VERIFY.’

- After all this process, verify your mobile number by verifying the OTP sent to your registered number.

- Click on confirm and reset your password.

How to Check EPFO Balance Online?

- Firstly, you go to the official webpage of EPFO: https://unifedportal-mem.epfindia.gov.in/memberinterface/

- Secondly, visit the member passbook page.

- Now, use your UAN password to log into your EPFO account.

- After that, select the member ID that is linked to your EPFO account.

- After you complete all the necessary details, your passbook will be displayed on your screen.

Also Read:- PF Balance Check With And Without UAN Number | EPFO Benefits & Process

Steps for e-Kyc for EPFO

You can follow the below given steps for updating your e–KYC for EPFO:

- STEP 1– Firstly, you need to log into the E-Sewa portal using your UAN and password given by the EPFO.

- Step 2– Once you log in to the account, go to the manage section, which is visible on the dashboard.

- Step 3 – Now click “KYC” in the manage section.

- Step 4– Now you will be directed to a page where you must enter all your necessary details like Aadhar card, PAN card, driving license, passport, election card, ration card, bank account details, and national population registered details.

- Step 5– After adding all the important information, select the checkboxes given to the KYC documents and save the information by clicking the save button.

- Step 6– After saving all the details, the data will be stored under the “pending KYC” within your account.

- Step 7– The EPFO will undertake the verification process for the given KYC details.

- Step 8– After completing the verification process, your KYC status will be updated.

- Step 9 – By completing the process, you will receive a notification regarding the updated status of your KYC.

Steps to claim forms

If you want to enjoy the facility of claiming forms, then you can follow the below-given steps:

- Before taking any steps, you must ensure that your Aadhar is linked with your UAN.

- Now visit the official website of EPFO: https://unifedportal-mem.epfindia.gov.in/memberinterface/

- It would help if you found a section dealing with claims or withdrawals on the portal’s dashboard.

- Select the form based on your requirements:

- Form 31– This form deals with the withdrawal of EPF funds for purposes like housing, medical treatments, or education.

- Form 19– deals with the final settlements of EPF funds upon leaving employment.

- Form 10c– Deal with the withdrawal of EPS funds.

- After choosing the form, fill in all the necessary details and attach all the essential documents such as bank account details, Aadhar card, or other documents.

- Now, submit the claim request through the portal.

- Once the authorities approve your request. The fund will be generated in your bank account.

Conclusion

The EPF scheme is one of the most beneficial because it encourages the country’s working class to save money. However, anyone can register and participate in this scheme through the EPFO portal. Both employer and employee can opt into this scheme. This article has provided all the details about the EPFO scheme.

FAQs:-

1) What is the complete form of EPFO?

The EPFO stands for the employee’s provident fund. It is an online platform that deals with various activities like pension and insurance schemes in India.

2) Describe key features of EPF.

The critical features of EPFO are employee services, real-time updates, accessibility, helpdesk support, etc.

3) What is the structure of EPFO?

The structure of EPFO consists of 3 schemes:-

1. The Employee Provident Fund Scheme, 1952(EPF)

2. Employees pension schemes 1992(EPS).

3. Employee’s Deposit Linked Insurance Scheme, 1976 (EDLI).

Recommended:-