Qoyod Accounting Software has become one of the leading solutions in Saudi Arabia and the region for small and medium-sized enterprises looking for an effective, reliable, and easy-to-use system for managing financial operations. With the growing demands of businesses for compliance, transparency, and integration, Qoyod stands out as a cloud-based accounting solution that offers more than just basic bookkeeping. It provides essential tools that empower business owners to handle invoicing, payments, inventory, reporting, and linkage with other software and authorities, meeting the unique challenges of today’s competitive markets.

Introduction

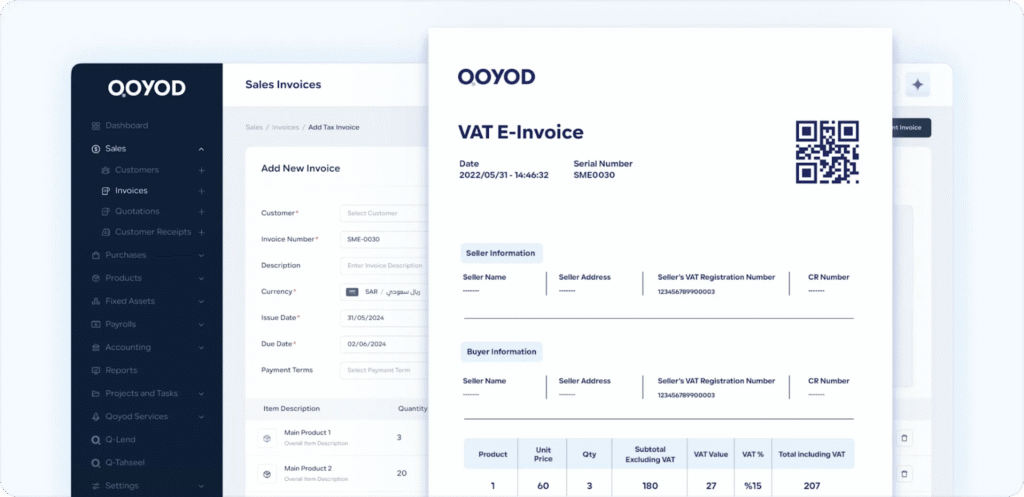

Managing finances in today’s business environment is a complex task that requires accuracy, efficiency, and adaptability. For small business owners, accountants, and finance managers, handling bookkeeping, complying with local regulations, issuing digital invoices, and generating precise reports can easily become overwhelming. This is where Qoyod Accounting Software steps in, offering an all-in-one system tailored for Saudi Arabian enterprises in particular.

Qoyod is designed to improve outcomes for businesses of all sizes, streamlining financial processes and making accounting accessible, even for those without extensive financial backgrounds. By providing easy-to-navigate dashboards, automated report generation, and integrated modules, Qoyod empowers users to track revenues, expenses, and cash flows accurately. Its cloud-based architecture ensures data security and accessibility from anywhere, enabling users to manage their accounts remotely, thereby improving productivity and supporting business growth ambitions.

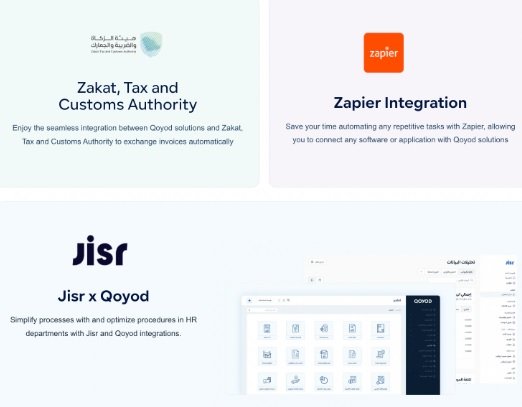

One of Qoyod’s strongest points is compliance: it supports the requirements of the Saudi Zakat, Tax and Customs Authority and is fully equipped for the new phase of electronic invoicing, making it a trusted choice for Saudi businesses. Moreover, Qoyod goes beyond routine accounting by offering features for inventory management, asset tracking, and cross-system integration—transforming accounting from a burden into a strategic management tool. Partnerships with auditing firms, banks, and other systems ensure seamless connection and efficiency, so business owners can focus on what matters: growing their business.

Qoyod Features for Financial Management

Qoyod’s feature set is comprehensive:

- Tracking and managing revenues, expenses, and invoices with high accuracy.

- Reconciliation of accounts and audit trails to ensure robust compliance and transparency.

- Generating detailed financial reports—balance sheets, P&Ls, cash flow—automatically and on-demand.

- Integrated inventory management that tracks products, costs, and supplier operations.

- Ability to link with point-of-sale (POS) systems and other external financial systems, enhancing automation and unified data management.

QLend Module

QLend module is a smart addition to Qoyod, designed to simplify the financing process for users. Instead of navigating through traditional, paper-heavy channels, QLend lets businesses apply for and receive funding directly from within the Qoyod system. Applications are handled quickly, with rapid approvals and transparent terms, allowing users to follow the status of requests and manage repayments as needed. QLend significantly increases access to finance for growing businesses and promotes financial inclusion and agility within the Saudi market.

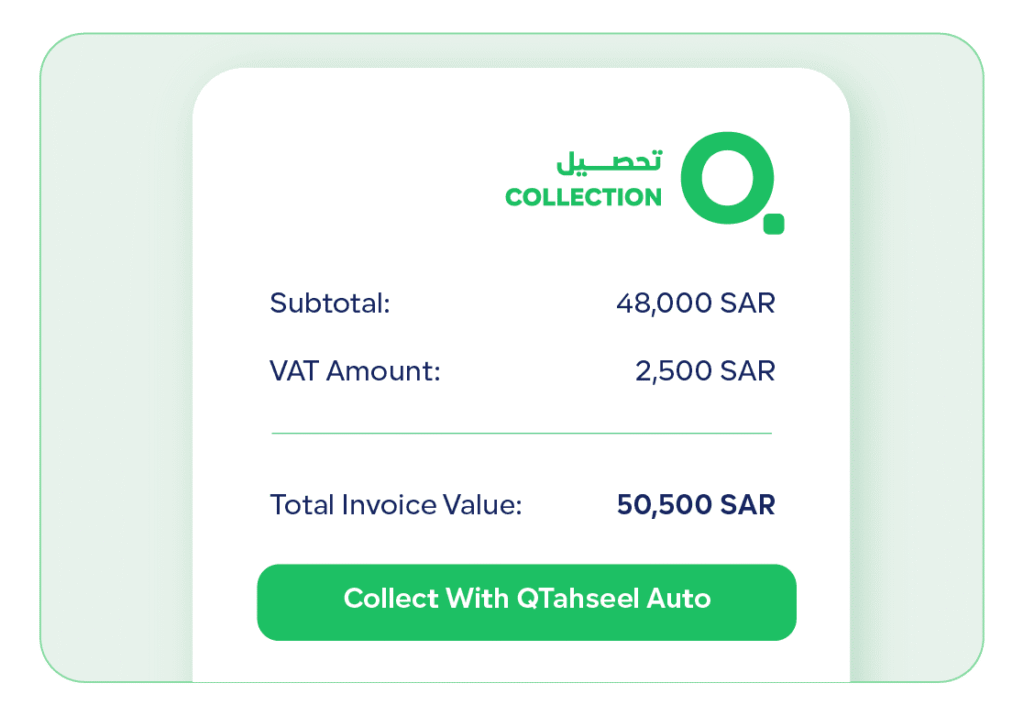

Qtahseel

Qtahseel is an innovative feature in Qoyod that streamlines invoice collection processes. Integrated directly with Qoyod’s accounting modules, Qtahseel automates billing, sends payment links to clients, and records payments instantaneously. This greatly reduces manual errors, speeds up collections, and provides accurate, real-time reports for monitoring payments and deposits. Institutions benefit from enhanced efficiency, lower operational costs, and improved reliability in managing receivables, supporting better cash flow management overall.

Bookkeeping in Qoyod

Bookkeeping within Qoyod is handled with exceptional ease thanks to intuitive dashboards and automated workflows. Users can record transactions, allocate expenditures, generate journals, and prepare compliant financial statements in accordance with Saudi standards. The transparency and accuracy offered by Qoyod ensure that transactions are properly documented and audited, supporting both day-to-day operations and strategic financial planning.

Why Use Qoyod and What Makes It Unique?

Qoyod outperforms many competitors by combining local compliance (including VAT and ZATCA e-invoicing) with modern usability and cloud flexibility. Unlike some systems that are either too complex or too generic, Qoyod is developed specifically for Saudi requirements and offers superior integration capabilities. Its pricing is transparent and reasonable for startups and SMEs, and the wealth of partnerships with accountants, banks, and service providers guarantees that businesses can always find support and expand their operations smoothly.

Leadership in E-Invoicing Phase Two and Partnerships

Qoyod is a trailblazer in supporting Saudi Arabia’s second phase of electronic invoicing. The software complies fully with requirements—digital signatures, encryption, and digital certificates—fostering confidence in every transaction. Qoyod integrates seamlessly with other technical ecosystems, such as inventory and CRM systems, simplifying business management processes. Its partnerships with various accountants, banks, and technical providers contribute to a secure and synergistic business environment for Qoyod users. This leadership ensures users remain ahead during digital transformation and regulatory updates, maintaining control and visibility over all their business activities.

In summary

Qoyod delivers a powerful, user-friendly accounting system tailored for the Saudi market, backed by modules and integrations that empower entrepreneurs and managers to efficiently run their financial operations and meet regulatory standards.