The E-Way Bill has emerged as an essential document for companies transferring goods within India in the fast-evolving GST scenario of today. This electronic compliance tool, or “Electronic Way Bill,” was established by the Goods and Services Tax to ensure transparency, faster movement of physical goods, and check tax evasion. Whether you are a manufacturer, trader, transporter, or a GST-registered person, it is essential to understand the E-Way Bill for the smooth and legitimate movement of consignments above a certain threshold.

This blog is meant to help figure out the E-Way Bill system, the way it comes into being, who needs it, how it actually operates, and why it holds such importance in the tax and logistics system of India. Well, if you have ever been puzzled by the GST transportation rules, this detailed tutorial would explain the mechanism of the E-Way Bill for you step by step.

What is Eway Bill System?

Meaning to streamline the movement of goods and to ensure compliance with tax, the E-way bill system under the GST regime in India was introduced as an electronic document. An E-way bill as the short form for “Electronic way bill,” needs to be generated by the person in charge as per the set rules, before moving goods from one state to another or sales worth more than ₹50,000. It contains important details such as consignor and consignee, description of goods, value, and vehicle details. It tracks goods movement in real-time, checks tax evasion, and encourages transparency along the supply chain. It needs to be physically carried along by the transporter, and it can be generated online via the official site, SMS, API, or through mobile applications.

What are the Components of E-Way Bill?

To proceed with the e-way bill process, you first need to understand the components of it, which are bifurcated into 2 parts which Part A & B. What details a person should require are written below:

1) Part-A

- Details of the GSTIN of the recipient

- Place of delivery, i.e., PIN Code

- Invoice or challan number and date

- Value of goods

- HSN code

- A transport document number, such as a bill of lading number, railway receipt number, goods receipt number, or airway bill number, is required.

- Reasons for transportation

2) Part B

- In contrast, Part B includes the transporter’s information and transport details (e.g., vehicle number).

When should the E-Way Bill Process be Issued?

When products worth more than Rs. 50,000 are moved in a vehicle or conveyance, then an E-Way bill is created.

E-Way Bills

When moving goods, you need to generate an E-Way Bill on the official portal, especially for certain goods, even if their value is under Rs. 50,000.

E-Way bill is compulsory in major situations such as:

- Moving goods from a principal to a job-worker across state lines.

- Transporting handicraft goods by dealers who aren’t registered for GST.

Also Read:- How to Become a CA || How to Check PF Balance Online

Who can Generate an E-Way Bill?

- Registered Person: When more than Rs 50,000 worth of goods are moved to or from a registered individual, an E-way bill needs to be created. A registered person or the carrier may choose to prepare and carry a bill even if the goods are valued less than Rs 50,000.

- Unregistered Person: Those who are not registered must additionally create an e-Way Bill. The recipient must, however, make sure all compliances are fulfilled as though they were the supplier in cases when an unregistered individual supplies a registered individual.

- Transporter: If the supplier has not created an e-Way Bill, transporters that transport products by air, train, road, etc., must likewise create one; however, they are not obliged to do so.

- The amount becomes less than or equal to the given amount when there is a single document (Individual).

- The amount could exceed in case all the documents are put together in an (aggregate) situation.

Through this table, you will get an idea of everything. Have a look:

| Who | When | Part | Form |

| Every Registered person under GST | Before the movement of goods | Fill Part A | Form GST EWB-01 |

| A registered person is a consignor or consignee, or is the recipient of goods (mode of transport may be owned or hired). | Before the movement of goods | Fill Part B | Form GST EWB-01 |

| The registered person is the consignor or consignee, and the goods are handed over to the transporter of goods. | Before the movement of goods | Fill Part B | Information about the transporter must be provided by the registered person in Part B of FORM GST EWB-01. |

| Transporter of goods | Before the movement of goods | NA | Generate e-way bill based on information shared by the registered person in Part A of FORM GST EWB-01 |

| An unregistered person under GST and a recipient is registered | Compliance to be done by the Recipient as if he were the Supplier. | NA | 1. The supplier or the transporter may not provide the conveyance details in Part B of FORM GST EWB-01 if the goods are being transported within the same State or Union territory for a distance of fifty kilometers or less from the consignor’s place of business to the transporter’s place of business for additional transportation.2. If supply is made by air, ship, or railway, then the information in Part A of FORM GST EWB-01 has to be filled in by the consignor or the recipient |

List of Union Territories Covered by the Intrastate E-Way Bill

- Andaman & Nicobar

- Chandigarh

- Dadar & Nagar Haveli

- Daman & Diu

- Lakshadweep

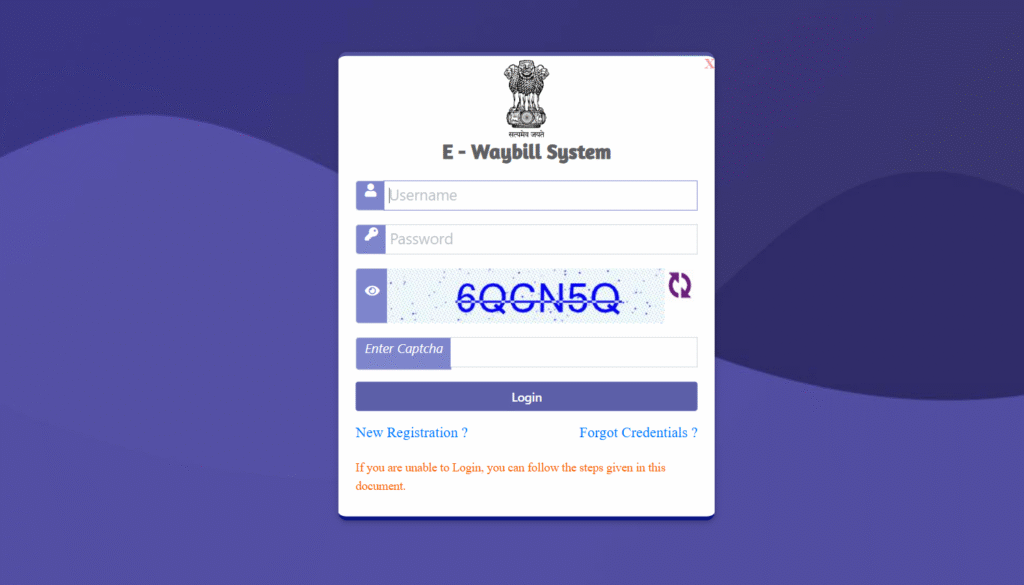

Steps/Process to Generate EWay Bill Log in

These steps will help you out in generating an E-Way bill log in. Follow the process:

- Step 1- EWay Bill Log in Portal, i.e., https://ewaybillgst.gov.in/, with your login credentials to access.

- Step 2- When you select the “Generate new” option, a new generation form will show up on the main menu page.

- Step 3- Fill in the required details,

- Select the translation type to “Outward” if you are a supplier

- If you are the recipient, choose the “Inward” translation option and, if necessary, input the recipient’s and supplier’s information as well as the GSTIN. Once a GSTIN number is entered, some of the forms will be automatically filled in.

- Step 4- Provide a goods description

- Just as on your tax invoice, the product name and description must be filled out completely and accurately.

- For the Product, enter the HSN Code. Click here to find the HSN code.

- Enter the applicable rates for CGST and IGST. For interstate transportation, IGST will be used, and for intrastate transportation, SGST/CGST.

- Enter the approximate transportation distance, which will determine the validity of the E-way bill.

- Step 5- Then click on “Submit” to generate an E-Way bill.

Note: To create an E-way Bill, a transporter’s registration and GST are required. Otherwise, you won’t be able to generate one.

Also Read: PCS Full Form || LPA Full Form || CTC Full Form || How to Become Marcos Commando

E-Way Bill Validity

It is one of the important things to get to know about the validity of E-way bills, as they are based on the distance the items have traveled. An e-way charge is valid for the times indicated below. Validity is determined using the e-way bill’s creation date and time.

| Type of conveyance | Distance | Validity of EWB |

| Other than over-dimensional cargo | Less Than 200 Kms | 1 Day |

| For every additional 200 km or part thereof | Additional 1 Day | |

| For over-dimensional cargo | Less Than 20 Kms | 1 Day |

| For every additional 20 Kms or part thereof | Additional 1 Day |

The Eway bill’s validity can also be extended by the person who generated it, either eight hours before or within eight hours of its expiration.

Beginning on 1 January 2025, e-Way bill validity extensions are limited to 360 days from the date of original generation.

Eway Bill Portal

The Government of India’s National Informatics Centre (NIC) created the official online platform known as the E-way Bill Portal to make it easier to create, manage, and track E-way invoices under the GST (Goods and Services Tax) system. It functions as a consolidated system for all GST-registered users, carriers, and tax officials and is available at https://ewaybillgst.gov.in.

How this portal helps users:

- Create, reject, modify, and cancel E-way bills.

- Utilize bill numbers or other criteria to keep track of E-way bills.

- Manage user accounts and register transporters.

- Get notifications, reports, and system updates.

- For major users, such as logistics organizations, employ APIs to integrate systems.

- Get the E-way Bill mobile app to access resources like FAQs and distance calculators.

EWay Documents and Required Details

- Documents or information needed to create an eWay Bill invoice, bill of supply, or challan for the shipment of goods

- Road transport- Vehicle number or transporter identification

- When the exporting of goods is done by ship, rail, or air, the things we need are the document’s date, transporter ID, and transport document number

Note: The appropriate officer may block a vehicle while it is in motion to inspect the cargo or verify documentation, such as the E-way bill (Important Information to keep this in mind).

Exemptions from E-Way Bill

Certain products and transactions are exempt from the creation of an E-Way Bill since they don’t need one are written down below:

1) Exemption for Goods (E-Way Bill)

- Natural/cultural stones or pearls/precious stones.

- Kerosene Oil under PDS.

- Liquid Petroleum Gas (LPG) is usually used for the supply of household purposes and non-domestic use.

- Jewelry

- Curd, Lassi, Any Milk product.

- Fresh or Pasteurized milk

- Fruits

- Vegetables

- Animals (Living), Plants, and Trees.

- Animal flesh, meat

- Salt

- Some items which does not contain a particular brand, usually, such as rice or wheat flour.

- Stationery products

- Unprocessed tea leaves

2) Exemption for Transactions

It is not required to create an E-way bill when products valued at 50,000 rupees are transferred from one location to another.

- If non-motorized vehicles are used to transport the items.

- If the land customs station, airport, and air cargo complex, a Container Freight Station for clearance by customs, or an Inland Container Depot.

- Transportation of the goods within the area.

- Transportation of goods to the Ministry of Defence

EWay Bills (Latest Developments)

- For returning non-filers, e-way bill production will be prohibited starting on August 15.

- GST officers now have access to real-time data on the movement of commercial vehicles on highways due to the integration of the EWB E-Way bill system with RFID and FasTag.

- This action will assist in monitoring these automobiles in real time and preventing GST avoidance.

- In GST (Goods and Services Tax), you will be required to use a six-digit HSN code.

- E-way bills can only be generated for intra-state goods transportation; they cannot be generated for interstate business-to-business transactions, and export invoices with the document type “TAX INVOICE” cannot be generated using the e-way bill portal.

- Invoices such as imports and B2C bills that do not require an IRN are not necessary. Direct E-way bills can be produced for these invoices.

- Using the seller’s and buyer’s postal identification numbers to calculate distance is one of the significant improvements made to the e-way bill. The determination of distance is based on the distance between two PINs.

FAQs

Q1: When is an E-Way Bill Required?

Ans– An E-Way Bill is required when goods worth more than ₹50,000 are transported within or across states.

Q2: Who can Generate an E-Way Bill?

Ans- Registered persons, unregistered suppliers, and transporters can generate an E-Way Bill.

Q3: What is the Validity of an E-Way Bill?

Ans- Validity depends on distance, 1 day for every 200 km for regular cargo and 1 day per 20 km for over-dimensional cargo.

Q4: Can the E-Way Bill be Extended after Expiry?

Ans- Yes, it can be extended either 8 hours before or within 8 hours after expiry.

Q5: Are There any Exemptions to the E-Way Bill?

Ans- Yes, goods like fresh milk, fruits, jewelry, and transactions via non-motorized vehicles are exempt.