EPFO has an online EPF0 Passbook service. It’s just like a bank passbook in that it helps to check the EPF account balance. It permits customers to check, download, and print the account history. The EPF passbook is a database that lists all services made to EPF and the EPS debts of each of the employees. The passbook lists all contributions made in a month. Any interest that has been made in the beneficiary’s account is also mentioned in the passbook. Read this article to learn about the EPFO passbook online, its download process, and the benefits of using EPFO passbooks

What is an EPF Passbook?

The EPF Passbook is like a bank passbook that guides you through the EPF contributions. It is a report given by EPFO that offers detailed information on all transactions associated with your EPF account. This consists of your contributions and organizations, ensuring complete transparency to your retirement savings.

Components of EPF passbook

Here are the components of the EPF passbook.

1) EPF account amount

This is the first and most important element of the EPF Passbook. The account number is in a numeral format. Let’s take an example to know the account number.

- Sample PF number – AP HYD 0074560 000 0001234

- AP represents Andhra Pradesh

- HYD represents Hyderabad that is the local office

- The next 7 numbers represent established order ID ‘0074560’

- The next 3 numbers constitute the extension ID. If no extension is provided, then it is 000.

- The last 7 numbers represent member ID ‘0001234.’

2) UAN

The universal account number is a unique 12-digit number issued to every EPF Member. Hence, each member and company has to get it when they join EPF. The EPF member IDs are related to UAN. This serves as an ID for the EPF account and further transactions.

3) Basic Details

The passbook incorporates basic information like name and address of status with establishment ID, member’s name, date of start, etc.

4) Opening Balance

The passbook shows the EPF balance in both columns for the company and employees. The starting balance is the full contribution, with the interest rate earned in a year.

5) Monthly Contribution

The EPF passbook suggests the monthly contribution by both employers and employees. However, contribution to EPS is reflected one by one.

6) Interest

The interest on EPF is calculated at the current balance of every month. However, the interest is earned at the end of the financial year for employee and company contributions. The interest rate on which the interest is calculated is mentioned in the passbook.

7) Withdrawals

In case the member makes any withdrawal in the year, the same is mentioned in the EPF passbook.

8) Closing Balance

The closing balance is the amount of company contribution plus interest and employee contribution plus interest. This total balance is carried forward as an opening balance for the following year.

9) Employees Provident Fund

Every employee has the option to make contributions more than the proportion of 12% in terms of EPF. The extra contribution made by employees is the Employees Provident Fund. Therefore, this is proven separately in the passbook.

Who can Access the EPF Passbook Online?

All EPF members can go to the EPFO portal online to access their EPF passbook. The following are the entities that cannot get access to their passbook online.

- Inoperative members

- Settled individuals

- Exempted status contributors

Also Read:- What is PF in Salary | What is Medical Allowance in Salary | What is Dearness Allowance in Salary

Benefits of EPFO e-Passbook

The following are the advantages of having an EPFO e-passbook

- The use of EPFO allows us to know about compliance and criticism for employees.

- Since the Employees’ Provident Fund is ruled through a statutory body, all groups need to follow all regulations and policies set by EPFO on a daily basis.

- EPFO makes the supply of online services available easily.

- With the help of EPF, the claim settlement time has been reduced from 20 days to 3 days.

- For employees, EPF allows you to save money.

- Monthly contribution to EPF makes it less complicated for running specialists to shop a very good amount of money for their requirements, as they do not need to take out a lump sum amount for investment.

- Employees also can withdraw part of their EPF during emergencies.

- EPF gives long-term investment for employees, even by building a retirement corpus for them.

- The part of an employee’s salary that is deducted from EPF is a part of their non-tax-deductible salary.

- Employees can transfer their EPF corpus from one agency to any other as and when they change jobs.

- EPF is the best tax-saving tool.

How to Download Your EPFO Passbook

Here are the steps below that will help you to download the passbook from EPFO:

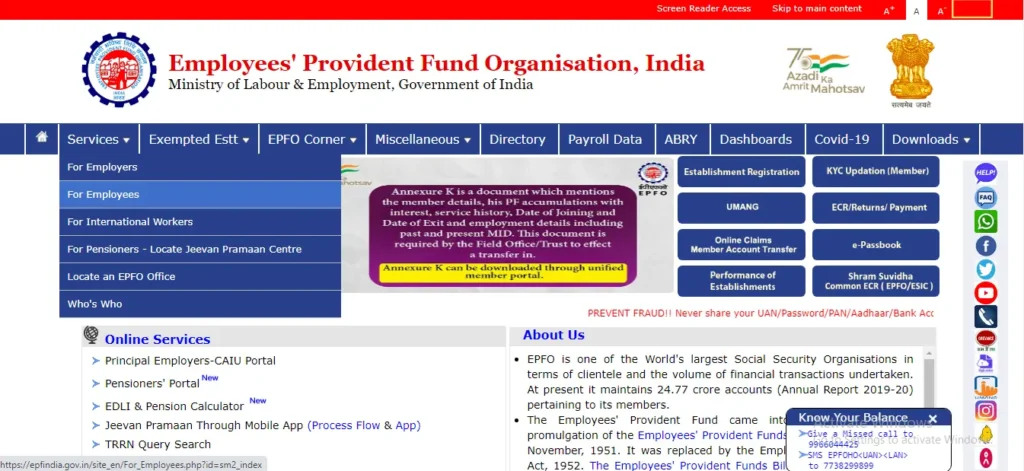

1) Visit the EPFO Official Website

You should visit the official EPFO website: https://www.epfindia.gov.in/site_en/index.php. This is your gateway to having access to your EPF Passbook online.

2) Log in to the Unified Member Portal

To get started, you can download the UMANG app from either the Google Play Store or the Apple App Store. This app gives an easy-to-use platform to get access to a number of government services, which includes roles associated with EPF (Employee Provident Fund).

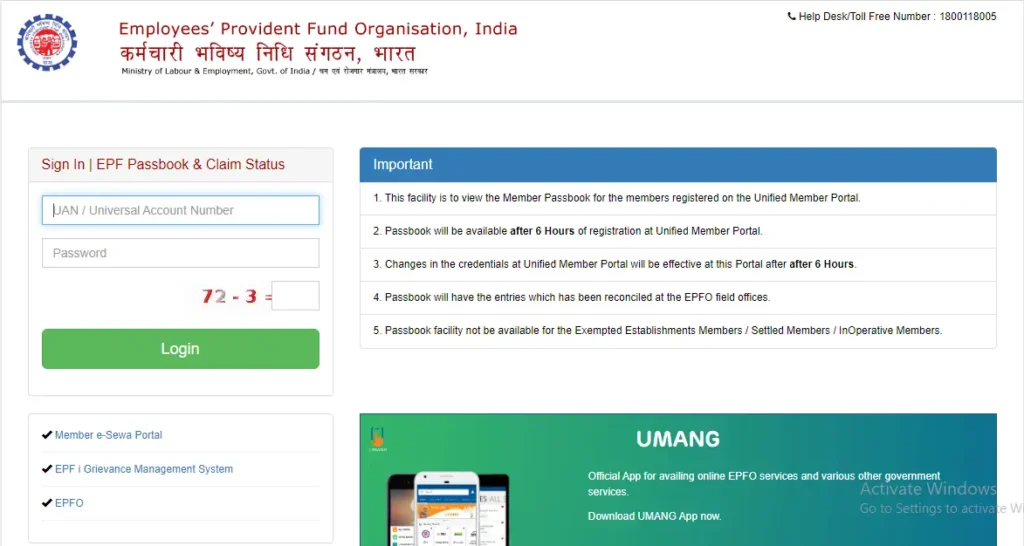

3) Log In

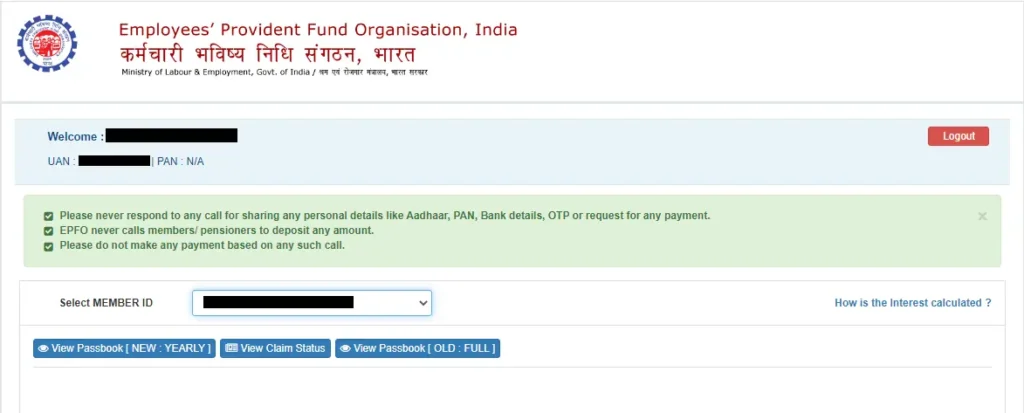

Once you’ve got your UAN, return to the homepage log in by using your UAN password, and fill in the captcha code. This step offers you access to your EPF account.

4) Access the Passbook

After logging in, you may find a ‘Download’ section on the main menu. Click on ‘Download Passbook’ to proceed.

5) Select Member ID

If you have multiple employers contributing to your EPF, you may need to choose your Member ID. Choose the applicable Member ID from the drop-down list.

7) Download the Passbook

When you select your EPF ID, tap on the download button. Your EPF Passbook might be generated in PDF format, which you can save or print.

UAN Registration

Each EPF member has a 12-digit account number, the Universal Account Number, that is obtained by every member and the company upon registration. The UAN and EPF member IDs are linked. This acts as the account’s ID for transactions. Here is the guide to help you perform UAN registration and achieve UAN

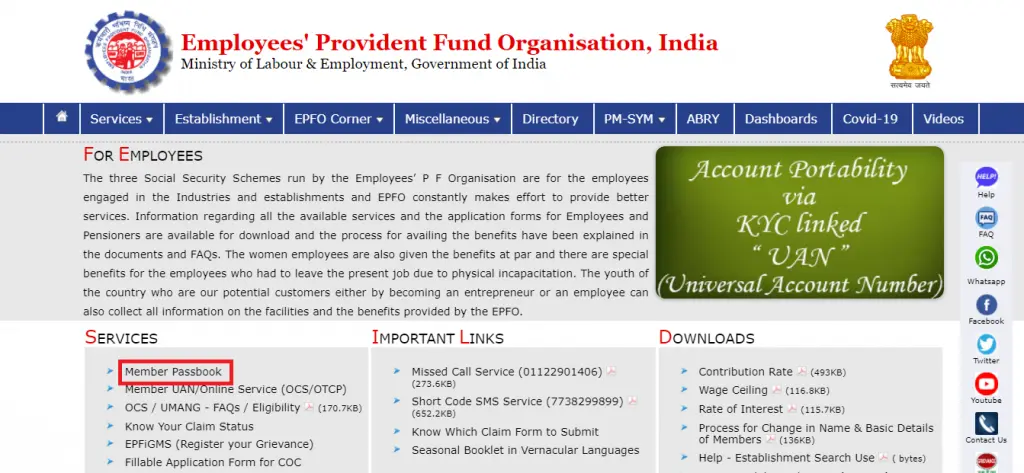

- Go to EPFO Portal. Move to ‘Services’ at the top navigation panel; a drop-down menu will appear. Select ‘For Employees,’ from the menu, and you will be redirected to another page.

- On the ‘For Employees’ page, click on ‘Member UAN/Online Service (OCS/OTCP),’ and you may be redirected to a new page.

- On this web page, click on “get your UAN,’ from the “important links” section.

- Enter your mobile number, fill in the captcha code, and request OTP.

- You will receive an OTP on your registered number; enter that OTP to get your UAN number.

- After validation, you will receive a message with the UAN number and its status on your phone.

Procedure to Activate UAN

Just obtaining the UAN amount is not enough to download your EPFO passbook. You also need to activate your UAN. The steps to activating UAN are given below.

- Visit the EPFO Portal and choose the ‘Activate UAN’ alternative.

- Register at the portal by using your personal information, like UAN/member ID, AADHAAR card number, date of birth, name, and phone number, and fill captcha code.

- An authorization PIN might be sent to the registered number once you’ve entered the vital records and submitted it. To confirm your information, enter your PIN.

- After PIN verification, your registration on the EPF/UAN portal is completed.

How to Download Your EPF Member Passbook Using the UMANG App

The UMANG (Unified Mobile Application for New-Age Governance) app gives easy access to your EPF Passbook on your mobile. Here’s how you can download it

1) Download the UMANG App

First, you must go to the Google Play Store or Apple App Store and set up the UMANG app. This app offered services associated with EPF (Employee Provident Fund)

2) Registration

After downloading the UMANG app, open it and complete the registration process. It consists of entering your phone number and receiving an OTP (One-Time Password) for verification.

3) Log In

Log in to the UMANG app by using your registered mobile range and OTP.

4) Access Your EPF Passbook

In the app, look for ‘EPFO’ and choose it. Then, choose ‘Employee Centric Services’ and opt for ‘View Passbook.’

5) Enter UAN

Enter your UAN (Universal Account Number) and the required details.

6) Download Your Passbook

Once logged in, you can view and download your EPF Passbook by using the app. It gives you access to maintain tabs in your EPF contributions anytime, anywhere.

Details Mentioned in an EPF Passbook

An EPF Passbook consists of the following details:

- Establishment ID and Employer’s Name

- Member ID and Employee’s Name

- EPFO Name and kind

- Detailed contributions to EPF (Employees’ Provident Fund)

- Detailed monthly contributions in the direction of EPS (Employees’ Pension Scheme)

- Interest in the amount with EPF

- Monthly deposits and withdrawals by company and employees

- Date and time of printing of the passbook

Keep in mind that if an employee has maintained one EPF account throughout their employment journey, they will be able to have an EPF passbook. On the other hand, if an employee has multiple EPF accounts, they will get more than one EPF passbook.

Alternative Ways to Check the EPF Account Balance

An e-passbook is the best way to get particular records about EPF transactions and account information. However, if you only want data about the account balance, you can use the given methods.

- Checking Balance through SMS:- Simply send an SMS to 7738299899 from your registered phone number with the text ‘EPFOHO UAN ENG’ to get your EPF account balance. Please keep in mind that ENG stands for English.

- Give a Missed Call: Members who’ve registered at the UAN Member Portal can get information about their latest PF contribution and PF balance by giving missed calls to 011-22901406 from their registered mobile numbers.

How is the EPF Passbook Updated

Regular updates are made in your EPF Passbook to reflect the latest transactions. This update generally happens every 6 hours, beginning with the contribution time. This implies that in this era, any contributions made through you or your company might be proven in the passbook. To make certain you are seeing the most recent transactions in your passbook, you have to look forward to this update.

Conclusion

Your EPF Passbook is not just a data-keeping passbook but also a gateway to economic empowerment and retirement readiness. Following the steps mentioned in this blog, you can download your EPF Passbook from the official EPFO website or the user-friendly UMANG app. This access to the passbook helps you to stay updated about your EPF contributions, plan your financial future, and get access to retirement funds. Making it a habit to often check and download your EPF Passbook, is an important key to ensuring that you are in the right direction towards your retirement goals.

FAQs:-

When does the EPF passbook get generated online?

The EPF passbook gets generated in up to six hours after a successful UAN registration at the EPFO internet site.

Who is eligible to download the EPF Passbook?

Only registered EPFO individuals can use the service to view and download their EPF passbook.

Do the EPF passbook entries get proven by EPFO?

All the mentioned entries are reconciled in EPFO discipline workplaces, after which they are updated on the EPF passbook.

How much time will it take for the online updates to reflect on the EPF passbook?

It will take around 6 hours for any changes or updates completed at the EPFO portal to reflect on the EPF passbook.