The salary slip of an employee is one of the significant financial documents for a salaried individual in India. Checking employee monthly salary slip, downloading employee salary slip for India Post, accessing employee salary slip for UP Govt, knowledge about your earnings & deductions definitely makes it easier for you to manage your taxes, savings, and plan your finances better.

What is an Employee Salary Slip?

A salary slip (or pay slip) is a legal document provided by an employer each month to an employee. It is a detailed account of the employee’s wages, deductions, gross, and net (in-hand) salary for a particular pay period.

In the present time, most organizations have started issuing monthly salary slips to their employees electronically. They can view their slip online – as UP Govt employee salary slip through state HRMS portals, India Post employee salary slip download through India Post employee login, etc. Salary slips can be downloaded in PDF format and used for official and financial purposes.

Components of an Employee Salary Slip

With the knowledge of these items in an employee salary slip, employees can monitor their earnings, tax deductions, and take confirmation of the salary paid. Earnings: This component is further classified into Earnings and Deductions.

Earnings

Before deductions, earnings are what an employee is paid.

Basic Salary

Salary slip of an employee has basic salary as the most important component, and it typically account 35–40% of the total salary. This component is taxable and is also used to calculate many other benefits like EPF, HRA, and bonus, etc.

Dearness Allowance (DA)

Dearness Allowance is payable to neutralise inflation. It is a part of basic salary and is fully taxable. DA is prevalent in all of the government pay scale which also includes the India post employee salary slip.

House Rent Allowance (HRA)

HRA is given to employees who stay in a rented house. Section 10(13A) provides an exemption which is the lowest of the following :

Actual HRA received

- Metro cities – 50% of Basic + DA Non-metro cities – 40% of Basic + DA

- Real rent paid HQ − 10% of Basic + DA

This part is very important while checking your employee’s salary slip for cost savings on taxes.

Conveyance & Medical Allowance

The Conveyance allowance will cover all of the commuting costs, and the medical allowance will cover all healthcare costs. The current tax law allows a standard deduction of up to ₹50,000, and the same is used in the employee’s monthly salary slip.

Performance and Special Allowances

These allowances are given as a reward for performance or together with the aim to motivate the employee. They are 100% taxable and part of the earnings on the pay slip.

Leave Travel Allowance (LTA)

LTA stands for Leave Travel Allowance, which includes travels of employees and their families. If the travel costs a company incurred can be shown to be actual costs incurred, then it may receive a tax exemption, with certain conditions. LTA is applicable over two travels for a block period of four years and must provide proof of travel as well.

Other Allowances

Other Allowances: Any other type of additional benefit, such as a uniform allowance, internet allowance, shift allowance, etc.

Deductions

To arrive at the net or in-hand salary from the gross salary, deductions need to be accounted for.

Employees’ Provident Fund (EPF)

EPF is a compulsory deduction, which is typically 12% of basic pay. It is a retirement savings plan in the long run and a tax deduction under sec 80C

Professional Tax

Professional tax is a state levy and differs from state to state. This is applicable in various states like Bihar, Maharashtra, Karnataka, West Bengal, Tamil Nadu etc., It can range between ₹200 and ₹2,500 per year and is mentioned in the employee salary slip.

Tax Deducted at Source (TDS)

The employer calculates TDS according to the taxable income of the employee. Tax-saving instruments such as PPF, ELSS, NPS, and tax-saving FDs can help employees lower TDS.

Read more: HRMS Bihar Salary Slip / How to Calculate Hourly Rate / Gadgetfreeks.com

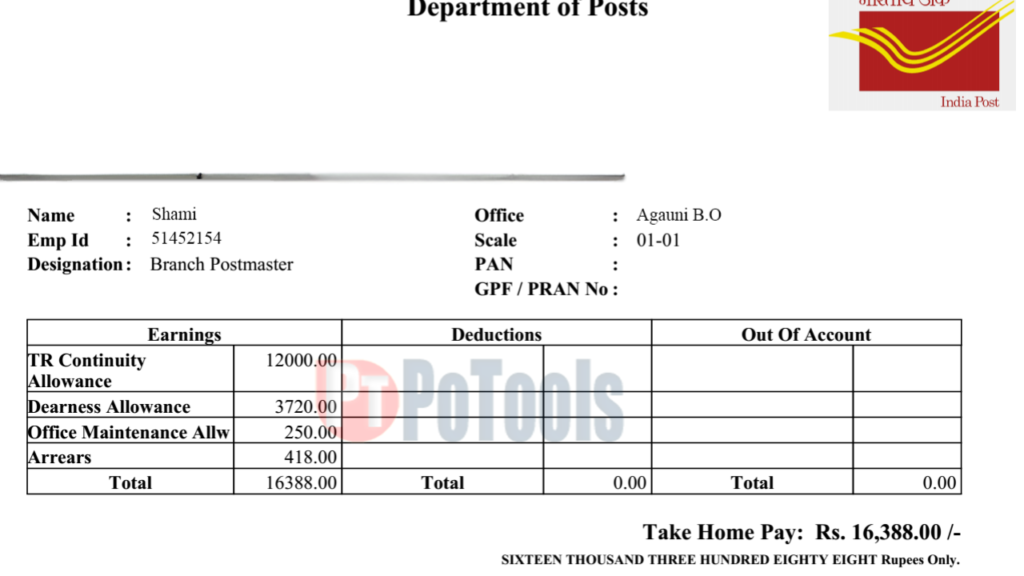

India Post Employee Salary Slip

An India Post Employee Salary Slip is a monthly salary statement issued to employees of the Department of Posts, Government of India. It includes the detailed calculation of each component of the salary, including basic, dearness allowance (DA), house rent allowance (HRA), transport allowance, and other permissible benefits as per the pay commission applicable. There are also deductions such as GPF or NPS, income tax (TDS), profession tax (if applicable), and insurance recoveries. Credit: endangeredcreative – Getty Images This document is legal proof of income and employment and is also used to file income tax, apply for a loan, calculating pension, and verify a service record, etc.

UP Govt Employee Salary Slip

UP Govt employee salary slip is an official letter that is issued to employees working in different departments of the UP (Uttar Pradesh) state Government. The salary structure that the state government and the pay commission rules approve is reflected in it. These include pay level, basic pay, grade pay (in certain cases), DA, HRA, medical allowance, and other benefits of a state-specific nature. Typical deductions in UP Govt employee salary slip are GPF or NPS, income tax deductions, professional tax, and other compulsory recoveries. The salary slips are usually created via the Uttar Pradesh HRMS or treasury portal and used for promotions, loans, audits, and retirements, among other things.

India Post Employee Salary Slip Download

India Post Employee Salary Slip Download Online Digital Format – India Post Provide Salary Slip through online in a digital format. The employees can download their monthly salary slip in PDF format by logging in at the official India Post or Department of Posts employee portal with their registered credentials. Having it available online helps employees to securely store their salary records, access slips of previous months, and use them whenever required for ter official or financial purposes like bank loans, visa applications, or income tax return. Harrison added that the digital system guarantees correctness, transparency, and convenient availability without requiring physical copies.

Employee Monthly Salary Slip

A monthly salary slip is one of the salary documents that are generated every month for people in the government sector, as well as the private sector. It gives a summarized paycheck of the respective month with a breakdown of your total earnings, total deductions, gross salary, and net in-hand salary. An employee’s monthly salary slip will enable a person to track his or her monthly income, understand the deductions made towards taxes, and have a better understanding of savings like EPF or NPS, as well as manage their monthly expenses effectively. These salary slips also become a valuable financial document for job switches, negotiations, loan approvals, and long-term financial planning over time.

What is the Difference Between CTC & In-hand Salary?

The total expenditure a company incurs on its employees in a year is referred to as Cost to Company (CTC). The total remuneration system encompasses the basic salary, allowances, bonuses, employer EPF contributions, and other perks.

Gross Salary: The pre-deduction component of the earnings

Net Salary or (In-hand Salary): This is what the employee ultimately receives in the bank account after deducting things like EPF, professional tax, and TDS. This amount is clearly shown on each employee’s salary slip, such as UP Govt employee salary slip, India Post employee salary slip, etc.

Why This Payslip Is Important For Employees?

Instead of just being a paysheet, an employee’s salary payslip has a legal nuance.

Proof of Employment

Salary payslips – these are formal records of your employment and your income. These are sometimes used for visa purposes, higher education programs, and background checks.

Income Tax Planning

A better understanding of your employee salary slip helps you identify taxable and non-taxable components, which in turn makes your income tax filing and planning simpler.

Loans and Credit Cards

To analyze the eligibility for loans, home loans, credit cards, etc., Banks and Financial institutions require recently issued employee monthly salary slips.

Job Change and Salary Negotiation

Previous salary slips help in negotiations and switching jobs. Some employers demand previous pay stubs as part of the onboarding process.

Better Financial Understanding

Mandatory savings such as EPF and ESI feature as deductions in the salary slips. Employees can plan their investments and expenses much more efficiently with knowledge of these details.

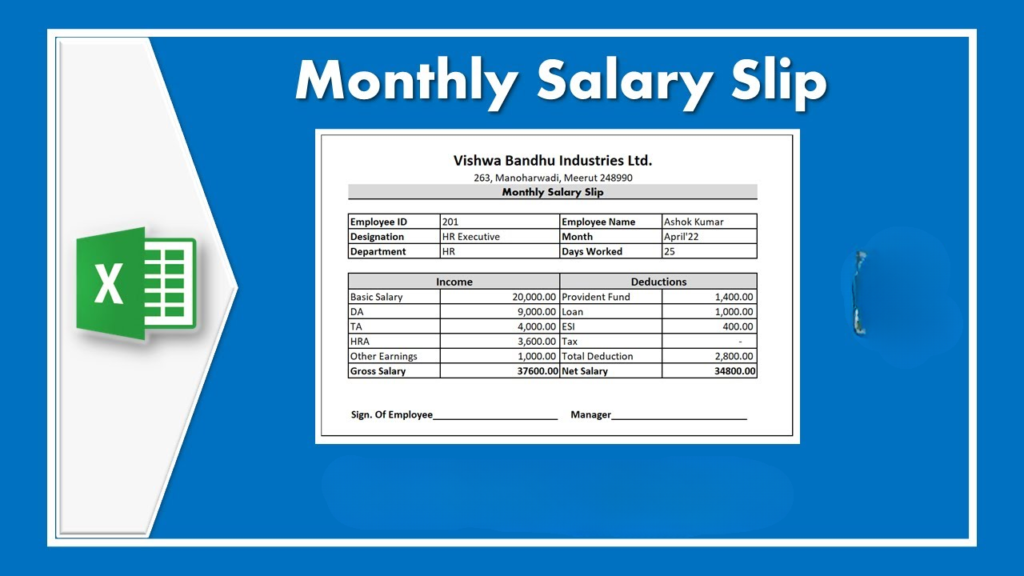

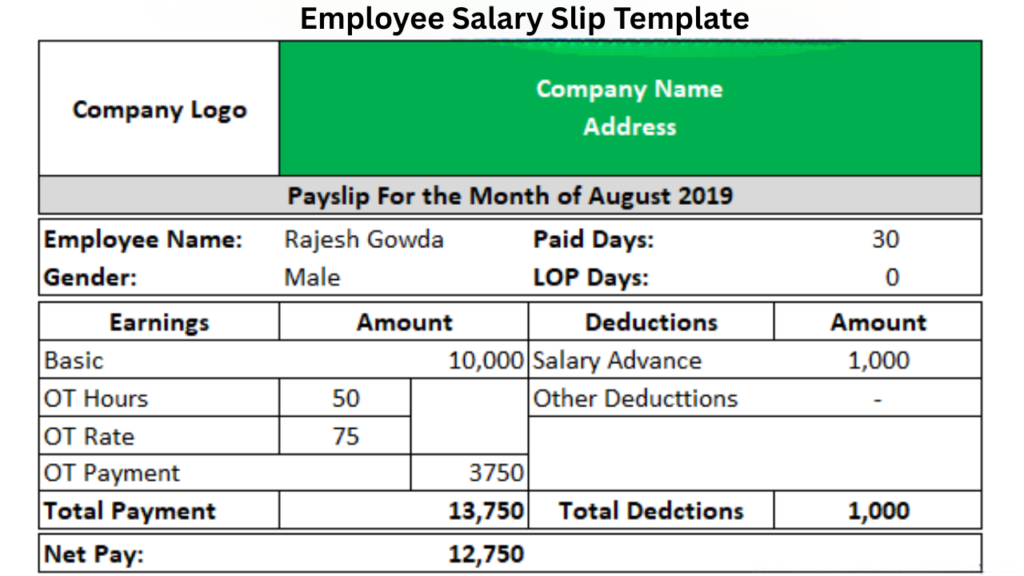

Employee Salary Slip Format

You may include the following in a typical employee pay slip format:

- From Company Name, Company Address, Exempt Salary Month

- Name, ID, title, and line of business

- PAN/Aadhaar number, Name of Bank, and Account Number

- EPF account number and UAN

- Working days and paid days, leave

- Detailed earnings and deductions

- Figures and words for gross salary and net (in-hand) salary

This format is followed in private companies as well as in government slips like the India Post employee salary slip, UP Govt employee salary slip, etc.

Employee Salary Slip Template

An employee salary slip template usually has the earnings on one side and the deductions on the other, after which contains gross pay and net pay.

Employees can access:

- Download the Wage Slips of Employees of India Post from the Official Portals

- PDFs of Employee Monthly Salary Slips from Company HRMS

These ensure transparency andan accurate record of the salaries.

Final Words

When you have a better understanding of your employee salary slip, it would help you in managing your taxes, savings, and career decisions very effectively. Be it about reviewing the monthly employee salary slip for an employee. downloading an employee salary slip for India Post or checking UP Govt employee salary slip, earnings, and deductions should be cross-checked closely every single time.

Understanding salary slips can assist you in creating a budget, enforcing effective spending habits, and planning a secure financial future.