Achieving financial freedom isn’t just a goal. It’s a mindset, especially for students navigating the complexities of both education and personal finance. As per BBC, more than 1/3rd of university students face severe problems with the cash flows. Whether you are dealing with student loans, part-time jobs, or simply trying to budget for life’s essentials, understanding how to manage your money is a crucial skill for success.

Books are a powerful tool to educate individuals on personal finance, budgeting, investing, and wealth-building strategies. In 2025, a growing number of authors and financial experts offer resources tailored to younger individuals, helping them develop good habits early on.

In this article, we’ll explore the 6 best finance books every university student must read in 2025 to learn how to manage your money wisely and set yourself up for financial independence in the future.

Let’s dive into the details!

A List of 6 Must-Read Books on Financial Freedom for University Students in 2025

In order to have a financially stable life, university students should have a deeper understanding of financial literacy and the way it works. Students often face quite a lot of financial challenges such as paying off debts, saving for the future or investments in different programs. To manage the financial strain, they often neglect their studies which unfortunately results in poor grades.

However, to cater to this issue, an affordable assignment writing service can lift the academic burden off the shoulders of students. Such a company can fulfil all the academic needs of students without costing them an arm and a leg.

The books that we have mentioned in the section below can help students become financially free at a young age. With the tips mentioned in these books, they can improve their money management skills.

Let’s have a quick look at these books that can let you navigate your money life and set you up for financial success.

1.Financial Literacy for Young Adults Simplified: Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future

Author: Raman Keane

Book Overview

University and college students often face greater financial challenges than other age groups. The mentioned book by Raman Keane has only 150 pages. By reading this book, they can understand how adopting the right mindset can empower them to take charge of their finances rather than being controlled by them. On Goodreads, this amazing book has a rating of 3.79 stars.

The list of factors covered by this book in detail is attached below:

- The students can learn how developing strong financial habits can lead them to security without giving up the things they love and hold so dearly

2. They can also get tips for creating a personalized budget and building wealth

3 . This book also teaches essential investment principles to students.

4. They also learn about the common investing mistakes to avoid when planning their finances

This book is particularly helpful for college students with part-time jobs or individuals working full-time while saving for their first home. By going through the contents, such students can learn how to invest their money in a meaningful way.

2. You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life

Author: Jason Vitug

Book Overview:

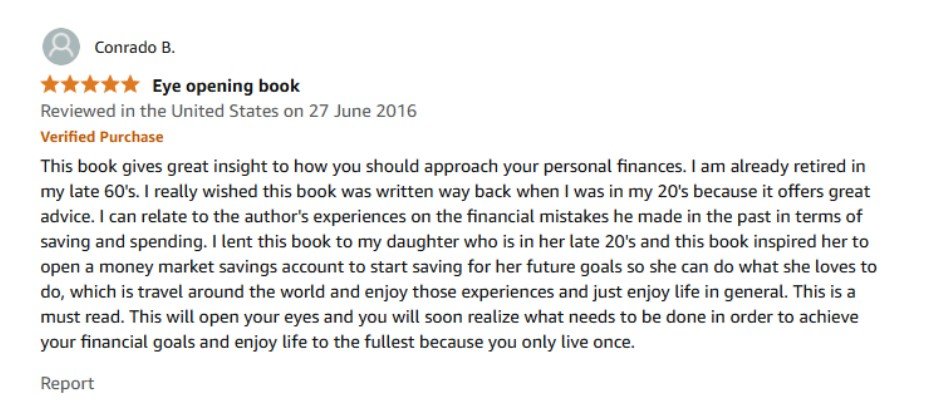

This amazing book has a rating of 4.5 stars on Amazon. The writer of this book is a financial expert who helps university students realise their dreams into reality. It also guides them on how they can achieve all their goals and make budgets for their expenses. Also, students learn how to take control of their money and how they can set themselves up for a debt-free future.

Here’s an Amazon review for you:

By reading this book, university students can learn to manage their savings and expenses. They can also practice mindfulness and good habits and resort to strict budgeting to manage all the expenses. Not only that, students also learns how they can live a clutter-free life and invest in the choices that make their lives even more stable.

3.Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Author: Vicki Robin and Joe Dominguez

Book Overview:

University students must not skip reading this book as it offers a piece of insightful advice to them on how to navigate their financial lives. For over two decades, Your Money or Your Life has been a top personal finance book for college and university students. They can find an outline of nine straightforward steps that young adults can take to secure long-term financial independence.

By reading this book, students can discover how to steer clear of debt and build healthy financial habits without relying on strict budgeting. One can also review an ecological perspective on personal finance and investments, such as spending money on online courses for dissertation writing. These aspects highlight how smart money management can help protect the environment and educate students on minimising the wastage of financial resources.

4. Risk Resilience Customer-centric sustainability

Author: Navin Munjal

Book Overview:

This book provides an excellent analysis of the risk management culture in the corporate world. University students can take this book as a valuable resource which can help them implement several effective risk management strategies. This knowledge is particularly helpful in small and medium enterprises. With clear definitions, the authors have presented the readers with tips to develop a strong foundation in Enterprise Risk Management (ERM).

Such essential tips are best for thriving in today’s competitive business landscape. By studying this book, students can also get a deeper understanding of implementation strategies, and get deep insights into risk management. When university students are aware of the best ways to navigate change, they also learn the top ways to manage their money in the right way.

5. The Psychology of Money

Author: Morgan Housel

Book Overview:

This book examines how human behaviours and patterns shape their financial choices. As compared to the conventional books on finance that offer tactics, Morgan has discussed the mental aspects of money in this book. She uncovers the relation of greed, patience, risk and choices.

University students can use this book as it helps readers understand the importance of long-term planning. By using the strategies mentioned in this book, the readers can achieve financial independence and can save themselves from unplanned expenses. You can also enhance your relationship with money and make better financial choices.

6. How to Get Financially Independent at an Early Age

Author: Jasdeep Chawla

Book Overview:

In this book, Jasdeep Chawla offers a practical roadmap for young individuals striving to attain financial freedom sooner rather than later. In today’s fast-evolving world, where early financial security is increasingly valued, university students can effectively take this book as a crucial guide. Chawla has also provided readers with the knowledge and tools to take control of their financial futures.

Emphasizing financial literacy as the cornerstone of independence, this book has also put a great emphasis on some of the most essential topics such as budgeting, saving, investing, and debt management. The author is commendable for simplifying complex financial concepts into clear, actionable advice. All of this has made this book accessible to readers from all backgrounds.

What Is the Number 01 Personal Finance Book of All Time?

The ‘Rich Dad, Poor Dad’ authored by Robert Kiyosaki is often considered the best-selling personal finance book, around the globe, of all time. Half of the mentioned book gives financial advice and half of it is considered a memoir. In this book, Kiyosaki shares his story when he grew up with two dads. He is of the view that an 8th-grade dropout who spends less than his income is smarter than a college professor who struggles to make ends meet. By reading this book, students can sort out their personal finances.

What Is the Best Financial Book of All Time?

If you are interested in learning about the management of investment, you can read ‘The Intelligent Investor’ by Benjamin Graham. The Reddit audience considers it one of the best finance books for all ages. It is known to provide a thorough introduction to the concepts of value investment and also offers practical advice on how to build a successful investment strategy for students.

The choice of the book depends on the taste of the learners. Students can also read the following books to get information about the best books on the financial freedom of students.

1. Think and Grow Rich

2 . The Psychology of Money

3. Rich Dad Poor Dad

4 . The Richest Man in Babylon

5 .The Millionaire Next Door

6 .A Random Walk Down Wall Street

Conclusion

We have discussed in detail the top 6 best books for financial freedom that every university student must read in 2025. It is always wiser to know how can you manage your finances and achieve financial freedom as soon as you can. It results in a better and less stressful life.

Many students face financial challenges, often working multiple jobs to cover their expenses. This leaves them with limited time to focus on their health and academic work. In such cases, budget-friendly yet reliable assignment writing agencies can offer much-needed academic support to make the educational journey smoother.

Lastly, you must remember one rule of thumb you do not have to spend more than what you earn. It can keep you from having a financial crisis and help you manage your expenses more efficiently than before.

Author Bio

Ruby Waters is a seasoned assignment writer who helps college and university students save their grades and go up the ladder of academic success. She also loves to offer helpful financial advice to students who are struggling with their money. In her leisure, Waters works on her home garden and takes care of her plants.